Future of B2B payments lies in embedded finance

Payments Dive

OCTOBER 7, 2022

“Unfortunately, the business-to-business market lags behind its B2C counterpart and is only just beginning to embrace embedded finance,” writes Melio COO Tomer Barel.

Payments Dive

OCTOBER 7, 2022

“Unfortunately, the business-to-business market lags behind its B2C counterpart and is only just beginning to embrace embedded finance,” writes Melio COO Tomer Barel.

Perficient

OCTOBER 7, 2022

Hurricane Ian slammed into Florida’s gulf coast and Georgetown, South Carolina, on September 28, leaving countless businesses and homes — if not wholly destroyed — drowned with flood water and without power. The Insurance Information Institute, an industry-funded research group, estimates that Ian has caused at least $30 billion in damage. Now that the storm has passed, residents are scrambling to assess damages to their homes and businesses and, if insured, begin the claims processes with their

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

OCTOBER 7, 2022

Uber’s new debit card will provide drivers up to 10% cashback on gas, 12% on EV charging and instant pay after completion of a ride or delivery.

Bobsguide

OCTOBER 7, 2022

Helen Cook joins Finastra as Chief People Officer. London, UK – October 6, 2022 – Finastra today announced the appointment of Helen Cook as Chief People Officer. In her role she takes global responsibility for the people organization and advancing the company’s aspiration to be the most inclusive and diverse employer in the Fintech industry. She is particularly passionate about building a curious and well-tooled workforce, supporting employees to develop skills that keep them relevant, eng

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

OCTOBER 7, 2022

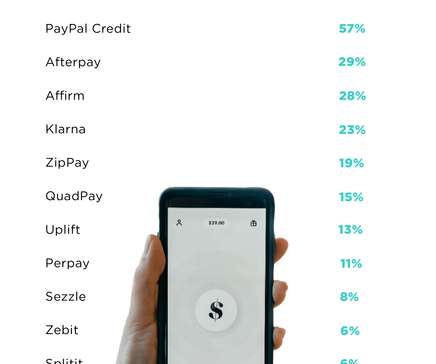

As spending shifts back to stores, retailers are side-stepping big-name buy now-pay later providers, such as Affirm and Afterpay, in favor of offering their own in-store options, a recent survey revealed.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

OCTOBER 7, 2022

The checkout-free company is looking to help its convenience store customers make more informed decisions on how to run their operations, CEO Jordan Fisher said.

ATM Marketplace

OCTOBER 7, 2022

As the technical capabilities of ATMs have increased, so has the sophistication of physical and digital attacks looking to access the cash and consumer data that ATMs store. Banks must understand these threats.

TheGuardian

OCTOBER 7, 2022

Predictions handed to chancellor expected to paint gloomy picture for UK economy amid sweeping tax cuts Kwasi Kwarteng has been handed independent forecasts on the state of the UK finances that are expected to show a hole of more than £60bn left by his sweeping tax cuts and a sharply slowing growth outlook. At the end of a turbulent week for Liz Truss’s government, the chancellor was on Friday handed the initial predictions for the economy and public finances by the Office for Budget Responsibil

BankInovation

OCTOBER 7, 2022

Microsoft on Tuesday announced new capabilities within its Cloud for Financial Services platform aimed at assisting financial institutions (FIs) with compliance and delivering digital services. FIs like Wells Fargo and National Australia Bank are already using the new platform to meet compliance needs using security controls, Bill Borden, corporate vice president of worldwide financial services […].

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

CFPB Monitor

OCTOBER 7, 2022

In a September 28, 2022 blog post , the CFPB examined the potential impact of rising vehicle prices on consumers with deep subprime credit scores, concluding that they are particularly likely to be financially vulnerable. . This is the CFPB’s second blog post in a matter of weeks examining the impact of rising vehicle costs on consumers. The first , published on September 19, 2022 and discussed here , focused on the impact of cost increases on consumers using information in consumer credit repo

BankInovation

OCTOBER 7, 2022

The Clearing House (TCH) continues adding financial institutions (FIs) to its real-time payments (RTP) network, as consumers and businesses gain a better understanding of the payment model to leverage B2B, B2C and ”me-to-me” payments. As of Tuesday, 269 FIs were live on TCH’s RTP network, up from 258 in the second quarter, Cheryl Gurz, RTP […].

SWBC's LenderHub

OCTOBER 7, 2022

As delinquencies begin to rise , your institution may be evaluating your internal operations and expenses to help you determine potential costs and impacts of scaling your collections department, compared to outsourcing one or more aspects of your operation to a third party.

BankInovation

OCTOBER 7, 2022

Tiger Global is looking to raise $6 billion for its next venture capital fund. The New York-based hedge fund recently invested in GrubMarket, ServiceUp, FlatLife, Zopper and Opto Investments in September, according to Crunchbase. The $6 billion ask, which was reportedly disclosed in a letter to investors this week, is less than half of its […].

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

CFPB Monitor

OCTOBER 7, 2022

In a recent blog post the CFPB warned mortgage lenders that “[l]enders that fail to have a clear and consistent method to ensure that borrowers can seek a reconsideration of value risk violating federal law.”. In the blog post the CFPB states the following: “Accurate appraisals are essential to the integrity of mortgage lending. Overvaluation can decrease affordability, make it harder to sell a home or refinance, and increase the risk of foreclosure.

Jack Henry

OCTOBER 7, 2022

We hope you enjoyed the recent Jack Henry Connect conference in San Diego! Building connections is at the heart of what we do, and we were thrilled to be back in person this year with four action-packed days of connecting with you through a host of networking events, social activities, technology exhibitions, and more dynamic speakers than ever before.

The Paypers

OCTOBER 7, 2022

Global fintech activating on the payments and transactional services industry, Worldline , has been selected by aviation company Lufthansa Group to become its partner and payments provider.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

OCTOBER 7, 2022

Financial messaging system SWIFT has laid out its blueprint for a global central bank digital currency (CBDC) network following an 8-month experiment on different technologies and currencies.

The Paypers

OCTOBER 7, 2022

The UK Payment Systems Regulator (PSR) has announced it intends to speed up the coming into force of requirements for mandatory reimbursement for consumers.

American Banker

OCTOBER 7, 2022

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

The Paypers

OCTOBER 7, 2022

The European Union has agreed on the legal text for licensed crypto firms, by passing the landmark Markets in Crypto Asset regulation (MiCA).

The Paypers

OCTOBER 7, 2022

EBA CLEARING , The Clearing House (TCH) , and SWIFT have announced that they are to deliver the Immediate Cross-Border Payments (IXB) pilot service.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content