Data to Be Reported with the FR 2052a Complex Institution Liquidity Monitoring Report

Perficient

MARCH 16, 2021

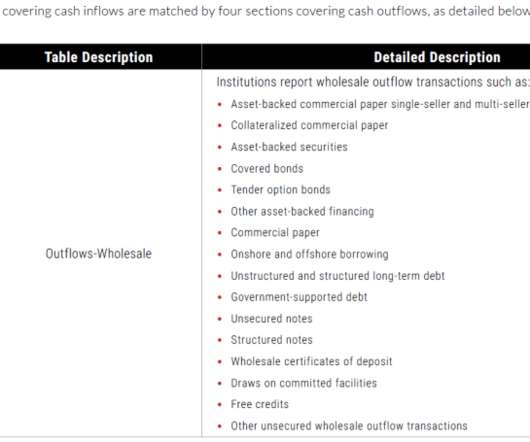

In my last blog I discussed the consolidations required for success with the FR 2052a Complex Institution Liquidity Monitoring Report. My next blog will outline the data that can be reported. The FR 2052a report collects data for 10 distinct tables covering 115 product types, 14 counterparty types, 72 asset classes, and 75 maturity buckets out to five-plus years, which are related to the assets, liabilities, funding activities, and contingent liabilities on a consolidated basis and by material r

Let's personalize your content