CECL Q Factors: Be Ready to Answer 3 Questions

Abrigo

JULY 12, 2021

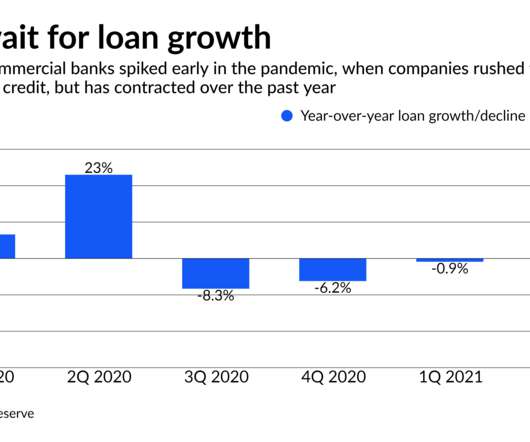

Q Factors under CECL and How They Will Compare Understanding the quantitative side of the CECL calculation is the start to applying qualitative adjustments under CECL. Would you like other articles on CECL and Q Factors in your inbox? Takeaway 1 Banks and credit unions moving to CECL in 2023 understandably want to know how Q factors will compare with current practices.

Let's personalize your content