Today’s Cyber Risk Management

Cisco

JUNE 7, 2022

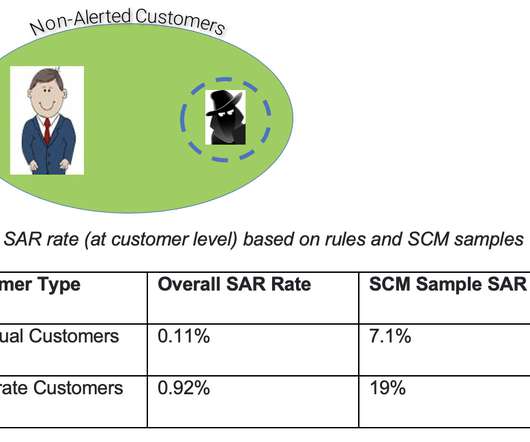

The past 20 years have visibly demonstrated the impact large scale events have on market, credit, and operational risks in financial services. The subsequent regulatory activity in response to these events focused on operational risks. Cyber risk is the largest and fastest growing operational risk within financial services.

Let's personalize your content