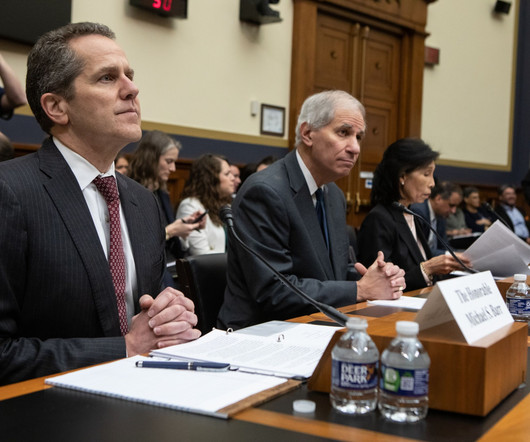

Discover, bracing for FDIC penalty, adds ex-agency official to its board

American Banker

SEPTEMBER 6, 2023

To help meet its compliance challenges, the company's board added a former FDIC regional director. The consumer lender's stock price has fallen more than 30% since its disclosure of a looming regulatory action, which was followed by the sudden departure of its CEO.

Let's personalize your content