The Best Opportunities for Retail Banks to Improve Customer Experience

Cisco

MAY 29, 2019

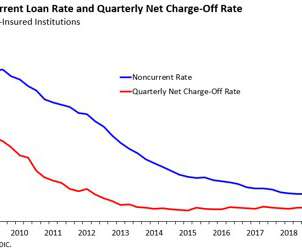

In retail banking, it’s clear customer experience matters, and the stakes have never been higher. Study after study confirms the importance of providing personalized, integrated experiences for satisfaction and retention of financial services customers. Opportunity #2: When customer satisfaction is on the line.

Let's personalize your content