Swap.com Uses Data Analytics To Fight Post-Holiday Fraud Surge

PYMNTS

JANUARY 13, 2021

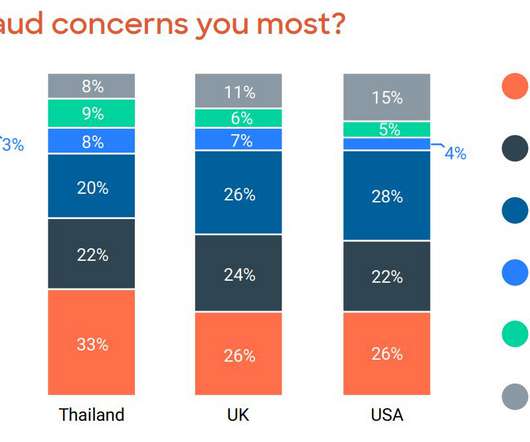

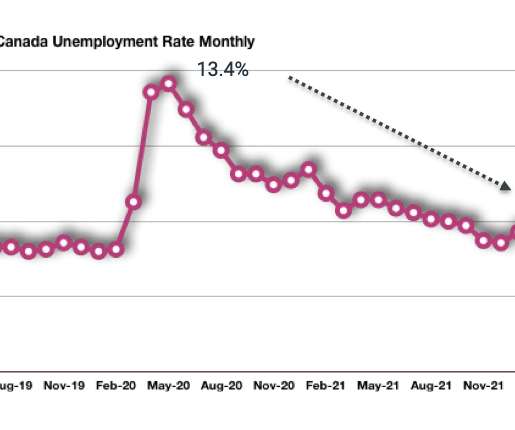

The prevalence of online commerce opens new doors for digital fraud, however, both from career fraudsters and opportunistic customers. percent had falsely claimed a charge on their credit card was fraudulent to score a refund. Developments F rom The World Of Digital Fraud. Developments F rom The World Of Digital Fraud.

Let's personalize your content