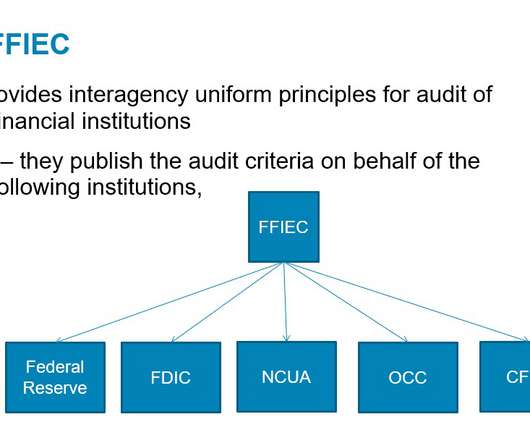

FDIC announces new resources for brokered deposits regulation

CFPB Monitor

APRIL 8, 2021

On April 1, 2021, the FDIC’s final rule issued in December 2020 revising its brokered deposits regulation became effective. The final rule also requires a third party relying on either of two Designated Exceptions (referred to as the “25 percent test” and the “enabling transactions test”) to provide written notice to the FDIC.

Let's personalize your content