The Death of the Community Bank

Jeff For Banks

JANUARY 14, 2021

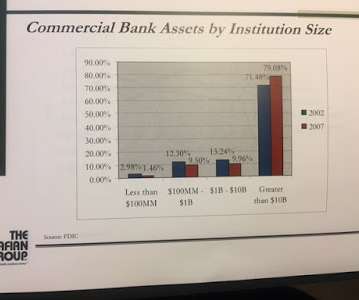

In June of 2008 I gave a speech titled "The Death of the Community Bank" and in that speech I made predictions. Much like the General Store fell victim to the supermarket and the lumber yard fell victim to Home Depot, I predicted the community bank that did not pick targeted customer niches or develop product expertise will meet it's doom.

Let's personalize your content