A Decade On, Lending Transformed By Crisis And Innovation

PYMNTS

SEPTEMBER 18, 2018

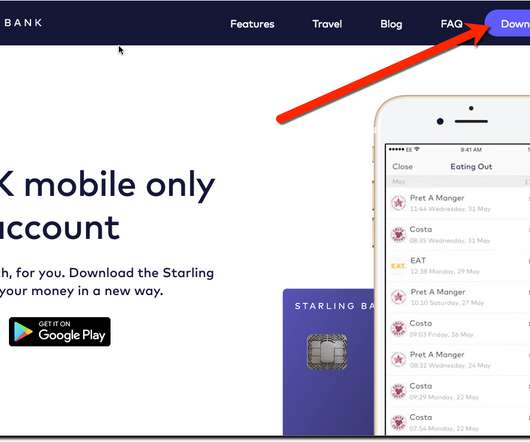

And in lending, with the financial crisis in the rearview mirror, a decade on, invention – okay, innovation – has become a hallmark, at least in some corners. But a standstill in the credit markets created a vacuum for a bit, at least along traditional lending conduits. It should be noted that almost all mortgage security finance (i.e.,

Let's personalize your content