Joint Guidance Provided to Banks to Manage Risks Associated With Third-Party Relationships

Perficient

JULY 12, 2023

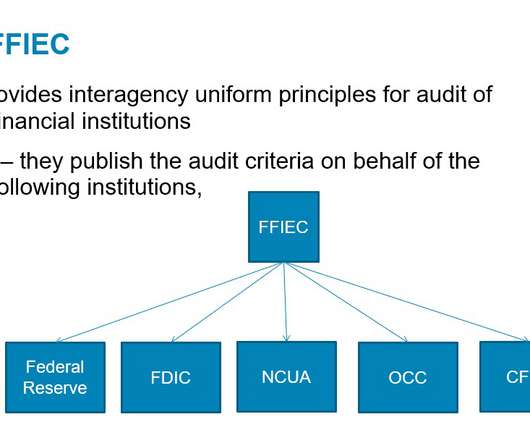

Perficient provides risk management to more than 500 financial services organizations, many of whom have multiple bank regulators. Often an organization will have a state-charted non-member bank, which has the FDIC as its primary federal regulator. It’s the guidance. The complete 60+ page guidance is available to readers here.

Let's personalize your content