Shopify cuts 20% of workforce

Payments Dive

MAY 5, 2023

The e-commerce platform’s cuts announced Thursday affect about 2,300 jobs, based on the company’s most recent headcount.

Payments Dive

MAY 5, 2023

The e-commerce platform’s cuts announced Thursday affect about 2,300 jobs, based on the company’s most recent headcount.

CFPB Monitor

MAY 5, 2023

The U.S. Supreme Court has agreed to hear a case in which the petitioners are challenging the continued viability of the Chevro n framework that courts typically invoke when reviewing a federal agency’s interpretation of a statute. While Loper Bright Enterprises, et al. v. Raimondo involves a regulation of the National Marine Fisheries Service (NMFS), the Supreme Court’s decision could have significant potential implications for when courts should give deference to regulations issued by all fed

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MAY 5, 2023

Supporters and opponents of the CFPB’s proposal to cap late fees at $8 clashed in comments to the agency in recent weeks.

ATM Marketplace

MAY 5, 2023

Is self-service technology killing cash? Or is cash still relevant? Read more to find out.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

MAY 5, 2023

Square parent Block is increasing compliance spending on personnel and software this year.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

The Paypers

MAY 5, 2023

Netherlands-based Crystal Blockchain has made its compliance and investigations tool, Crystal Expert, available to universities around the world.

TheGuardian

MAY 5, 2023

Macquarie’s net profit is up 10% with top commodity trader landing A$58m through profit-share deal Business live – latest updates The Australian banking group that controls Southern Water, the utility company criticised for discharging sewage into the sea, has posted record profits after a boom in its commodities trading division. Macquarie, which owns a string of UK infrastructure assets, recorded an annual net profit of A$5.18bn (£2.8bn), up 10% on the previous year.

The Paypers

MAY 5, 2023

US-based payments processor Stripe has launched a fiat-to-crypto onramp, to make it easier for Web3 companies to help customers purchase crypto.

TheGuardian

MAY 5, 2023

Shares in US regional banks pummelled this week amid fears of more collapses in sector Business live: latest updates The crisis engulfing regional US banks risks becoming a “self-fulfilling prophecy” as investors take flight from lenders seen as increasingly risky bets, triggering even deeper losses, analysts have warned. Shares in US banks were pummelled this week amid investor concerns that there will be more collapses, after a string of failures.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

BankInovation

MAY 5, 2023

Apple increased revenue in its payment services in the second quarter ending April 1 as the tech giant focused on its savings account; buy-now, pay-later service; and payments software offerings.

TheGuardian

MAY 5, 2023

Majority of shareholders reject proposal to spin off Asian operations, after hour of disruption from campaigners Business live – latest updates HSBC has defeated an attempt to split up the bank after a majority of investors rejected a plan backed by its largest shareholder at the bank’s annual general meeting, which was heavily disrupted by climate protests.

BankInovation

MAY 5, 2023

Vesey Ventures has launched a fintech startup fund with $78 million in capital to help early-stage tech companies get off the ground. The fund invested capital in five fintechs so far, including cybersecurity and identity protection firm Cyrus, and embedded foreign exchange solution Grain, among others, according to a release from the company.

TheGuardian

MAY 5, 2023

We want to speak to people in the UK who have been defrauded via Instagram, Facebook and WhatsApp amid an uptick in online scams Scams via Meta’s platforms Facebook, WhatsApp and Instagram have soared , TSB Bank has said as it urged the parent company to protect consumers. The bank said that 80% of cases in its main fraud categories come from scams on Meta platforms.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

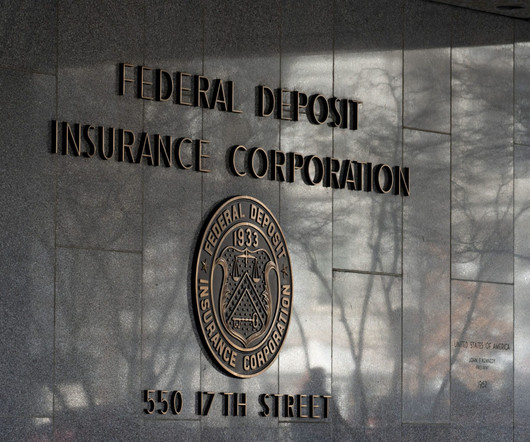

BankInovation

MAY 5, 2023

Tech-forward Cross River Bank reached a consent agreement with the Federal Deposit Insurance Corp. in March following a cease-and-desist order from a standard review in 2021 regarding “unsafe and unsound banking practices related to its compliance with applicable fair lending laws,” according to the consent agreement.

The Paypers

MAY 5, 2023

Next-gen automated retail company Invenda Group has partnered with fintech platform Adyen to improve its retail offering with an advanced payment solution.

The Paypers

MAY 5, 2023

US-based Equifax has launched a new Kount Essentials fraud detection and prevention app on the Shopify App Store to address the challenges faced by small business merchants.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Paypers

MAY 5, 2023

US-based digital bank Greenwood has acquired Kinly , a mobile banking platform targeting underserved communities, for an undisclosed amount, according to Fintech Global.

The Paypers

MAY 5, 2023

Global SaaS platform Wix has partnered with the shipping platform for modern ecommerce Shippo to launch a native shipping solution to improve the delivery process.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

MAY 5, 2023

US-based fintech provider Velmie has released an updated, composable white-label solution with a card module to build and launch a fintech business in a fast way.

American Banker

MAY 5, 2023

The Paypers

MAY 5, 2023

The Financial Conduct Authority (FCA) has used its powers to check sites in Exeter, Nottingham, and Sheffield suspected of hosting illegal crypto ATMs.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content