Visa stands by crypto

Payments Dive

JANUARY 26, 2023

At the card giant’s annual meeting Tuesday, CEO Al Kelly showed no signs of backing off crypto. He also suggested Visa’s management team may change after he exits as CEO.

Payments Dive

JANUARY 26, 2023

At the card giant’s annual meeting Tuesday, CEO Al Kelly showed no signs of backing off crypto. He also suggested Visa’s management team may change after he exits as CEO.

Accenture

JANUARY 26, 2023

The world of commercial banking faces uncertainty today. As a result, it is difficult to make confident decisions about the medium-to-long term. However, Accenture believes commercial banks have an opportunity to reinvent themselves and reposition for the future. Unlike in the 2008 financial crisis, banks today are well-capitalized and better prepared to withstand economic shocks.… The post Commercial banking top trends in 2023 appeared first on Accenture Banking Blog.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JANUARY 26, 2023

A second director resigned this month from the mega payment processor’s board as it undertakes a comprehensive review of its operations.

SWBC's LenderHub

JANUARY 26, 2023

As we discussed in Part 1 of Modernizing the Property Valuation Process , the housing market has experienced dramatic changes that have presented many challenges for appraisers. Although the market has shifted, the challenges remain. While initiatives put in place by Practical Applications of Real Estate Appraisal (PAREA) and The Appraiser Diversity Initiative to provide alternative pathways for aspiring appraisers to join the industry and decrease the shortage of appraisers represent a good sta

Advertisement

Discover the key benefits of portfolio loans and learn how to streamline your lending process with our infographic, "5 Things Lenders Need to Know About Portfolio Loans & Their Documentation." Find out how portfolio loans can maximize borrower potential by consolidating multiple properties under a single loan, reducing paperwork, and lowering closing costs.

Payments Dive

JANUARY 26, 2023

The early wage access provider has been raising capital to fund expansion in the U.S. and internationally.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Jeff For Banks

JANUARY 26, 2023

I recently spoke to a community group, and subsequently a community bank all-staff meeting regarding the definition of a community bank. The FDIC has defined community banks in their December 2020 Community Banking Report that either exclude or include the following criteria: Seems complicated. Especially when a community bank could have no office with more than $8.24B in total deposits but could have no more than $1.65B in total assets.

BankUnderground

JANUARY 26, 2023

Martina Fazio and Gary Harper During recessions, and indeed pandemics, housing prices usually fall. Yet between March 2020 and December 2021 (‘the pandemic’), housing prices grew in the UK, reaching at the time their highest growth rate in a decade. During this pandemic, many more people could work from home, which potentially influenced their housing choices.

TheGuardian

JANUARY 26, 2023

Government lifted cap on bankers’ bonuses in September, allowing them to ‘help themselves’ to unlimited payouts, TUC said Bankers’ pay has risen more than three times as fast as nurses’ pay since the 2008 financial crisis, according to an analysis by the TUC, which said low paid nurses are being forced to rely on handouts from food banks. The unions’ umbrella body said pay and bonuses for those working in the finance and the insurance sector had risen by an average of 6% a year in nominal terms

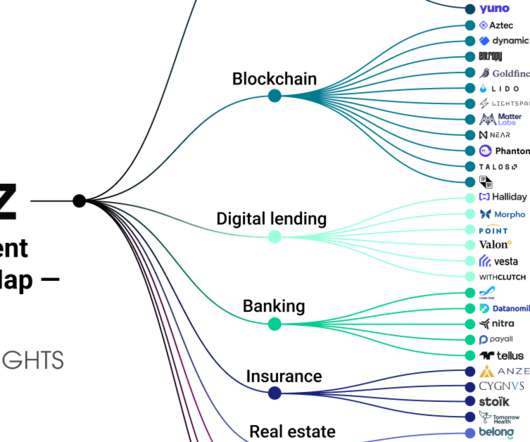

CB Insights

JANUARY 26, 2023

The fintech industry took a hard hit in 2022 as investors scaled back their investments amid market turmoil. However, some top investors like Andreessen Horowitz (a16z) remained active in the space across various deal stages, valuations, geographies, and sub-industries. Fintech is central to a16z’s investment strategy. In recent years, the firm has not only shored up its presence in more familiar sectors like banking, but also reached deeper into newer territory like blockchain.

Speaker: Brian Muse-McKenney, Chief Revenue Officer & Matt Simester, Cards and Payments Expert

In today’s world of social media, dating apps, and remote work, businesses risk becoming irrelevant or getting "ghosted" if they fail to meet the evolving needs of Gen Z consumers. In this new webinar, Brian Muse-McKenney of Episode Six and Matt Simester of Payments Consultancy Limited will reveal key considerations banks should factor into their efforts to develop target products for the next generation of bank customers.

TheGuardian

JANUARY 26, 2023

High street banks have now announced 87 closures so far this year – see full list of NatWest closures below NatWest is to shut another 23 branches in England and Wales, adding to a raft of high street banking closures already announced this month. The sites will close in the first half of this year. The bank said the closures were due to more customers moving to mobile and online banking.

CFPB Monitor

JANUARY 26, 2023

In a letter to Director Chopra , five banking trade groups address the CFPB’s obligation to comply with the Small Business Regulatory Enforcement Fairness Act of 1996 (SBREFA) before proposing a rule on credit card late fees and late payments. The groups are the American Bankers Association, Credit Union National Association, Independent Community Bankers of America, National Association of Federally-Insured Credit Unions, and National Bankers Association.

TheGuardian

JANUARY 26, 2023

Most employees will receive bonus worth almost 12% of pay for 2022, while CEO will be handed £782,000 TSB’s 5,700 staff and executives are to share a 10% bigger bonus pot this year, after rising interest rates pushed the bank’s annual profits to record highs. The high street lender confirmed the pool had risen to £29.8m, up from the £27m distributed a year earlier.

CFPB Monitor

JANUARY 26, 2023

The CFPB has filed its brief in opposition to the cross-petition for certiorari filed by Community Financial Services Association (CFSA). The CFPB’s certiorari petition seeks review of the Fifth Circuit panel decision in Community Financial Services Association of America Ltd. v. CFPB. In that decision, the panel held the CFPB’s funding mechanism violates the Appropriations Clause of the U.S.

Speaker: Gary Dmitriev

Our upcoming webinar aims to demystify the process of selecting and implementing automation tools for financial institutes. This session will provide your roadmap for vetting potential solutions, focusing on due diligence, vendor assessments, and aligning technology with strategic goals. We’ll also address the critical issue of innovation fatigue, offering tips on maintaining enthusiasm and momentum for new initiatives.

CB Insights

JANUARY 26, 2023

With the rise of retail investment platforms, the investment landscape has changed dramatically in the last decade. These solutions allow individuals to bypass institutional investors and control their own portfolios, offering a cheaper, faster, and more hands-on experience. DOWNLOAD THE STATE OF FINTECH 2022 REPORT Get the latest data on global fintech investment trends, the unicorn club, sectors from banking to payments, and more.

CFPB Monitor

JANUARY 26, 2023

On January 19, 2023, the U.S. Court of Appeals for the Third Circuit unanimously affirmed a district court’s dismissal of a Telephone Consumer Protection Act claim arising from allegedly illegal faxes about a free educational seminar. Appellee Millennium Health LLC operated a laboratory providing drug testing and medication monitoring services to healthcare professionals, including Appellant Dr.

BankInovation

JANUARY 26, 2023

Successful innovation in business requires much more than just a good idea. Strategic planning and having the proper teams and technology are also key, but what might be the most important element is listening to what the client wants.

CFPB Monitor

JANUARY 26, 2023

The CFPB has issued a new request for information (RFI) to inform its biennial review of the credit card market mandated by the Credit Card Accountability Responsibility and Disclosure Act of 2009 (CARD Act). Comments on the RFI must be received by April 24, 2023. The CFPB’s first CARD Act report was published in October 2013, its second report was published in December 2015, its third report was published in December 2017, its fourth report was published in August 2019, and its fifth report wa

Advertisement

Discover First Mid Bank's Expansion Success with Our Case Study! Discover how First Mid Bank & Trust fast-tracked market expansion through advanced automation and compliance solutions. This case study reveals their journey from facing challenges in Texas' complex legal landscape to achieving rapid market entry with GoDocs' innovative commercial closing platform.

BankInovation

JANUARY 26, 2023

People across the country are paying closer attention to their finances as predictions for an upcoming recession persist. This economic uncertainty, coupled with lingering financial impacts from the pandemic and rising inflation, have made many uneasy about their financial fitness.

CFPB Monitor

JANUARY 26, 2023

The eyes of the consumer finance world are now on the Supreme Court as it decides whether to grant the CFPB’s certiorari petition in Consumer Financial Services Association Ltd. v. CFPB. In the decision, a Fifth Circuit panel held the CFPB’s funding mechanism violates the Appropriations Clause of the U.S.

Commercial Lending USA

JANUARY 26, 2023

A new home construction loan is a type of loan that is used to finance the construction of a new home. These loans typically have a shorter term than traditional mortgages and are typically interest-only during construction.

BankInovation

JANUARY 26, 2023

IBM’s hybrid-cloud efforts paid off in the fourth quarter of 2022 following a strategic prioritization of cloud and AI strategies in the prior quarter.

Advertisement

Shifting liability for digital fraud losses represents a significant challenge for financial institutions and payment service providers. In response to the global surge in digital fraud, regulators are introducing policies that transfer the cost of fraud from defrauded customers to financial institutions. ThreatMark’s newly released white paper, "The Liability Shift: Understanding Fraud Losses Responsibility and Mitigation," provides an in-depth analysis of this shift, its implications, and stra

The Paypers

JANUARY 26, 2023

US-based online travel agency KAYAK has partnered with Affirm to give travellers more spending power and payment flexibility when booking through KAYAK.

The Paypers

JANUARY 26, 2023

Digital lending platform for ecommerce ZoodPay has partnered Mastercard to launch a prepaid virtual instalment card in the Eastern Europe, Middle East, and Africa (EEMEA) region.

Advertisement

Most people dread the nearing of the month-end close and reconciliation process, and who can blame them? It's typically a tedious, long, stressful process; but it doesn't have to be. Implementing automation into your month-end process can significantly reduce this headache by automating up to 40% of your reconciliation and saving nearly 30% of your time spent.

Let's personalize your content