The challenges of measuring financial conditions

BankUnderground

APRIL 6, 2023

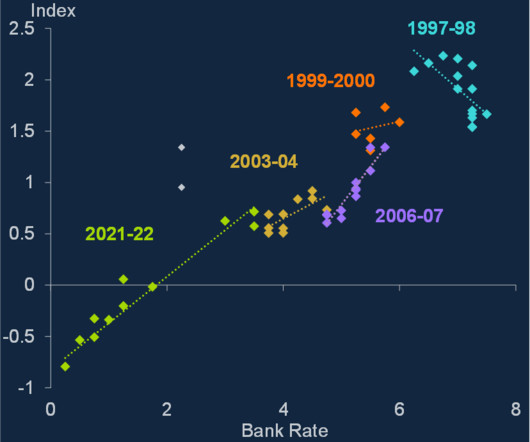

Natalie Burr The challenge of measuring financial conditions Imagine you were tasked with thinking about how financial conditions have changed over a policy tightening cycle. Different economists would come to very different conclusions, and none would necessarily be wrong. Why? Because measuring financial conditions is challenging – for a variety of reasons.

Let's personalize your content