Revolutionizing the Way We Pay: The Top Payment Industry Trends You Need to Know in 2023

Perficient

FEBRUARY 2, 2023

Across industries, consumers are communicating the same demands; they see the thing, they want the thing, and they want it in their hands within hours, if possible. And if it’s not possible, they wonder why not since it usually is through Amazon. Because money is what makes the world go-’round, the payments industry has responded to this heightened sense of urgency from consumers to get ahold of merchandise, services, and funds seamlessly, immediately, and with little to no human interacti

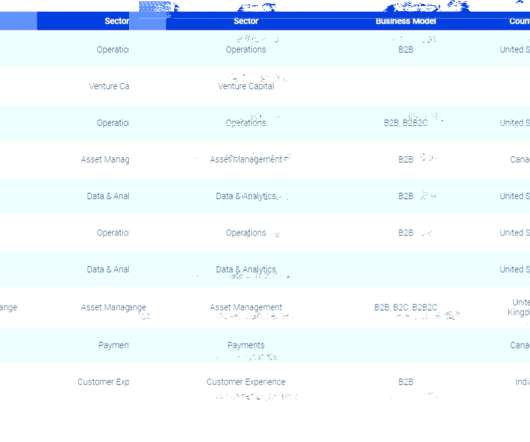

Let's personalize your content