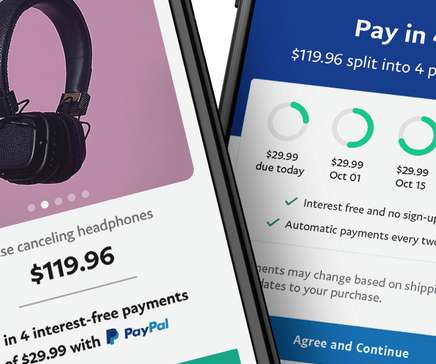

Extra costs biggest reason shoppers ditch online carts

Payments Dive

SEPTEMBER 22, 2022

With cart abandonment costing online retailers up to $136 billion annually, Coresight Research’s findings suggest they might want to focus on total purchase price more closely matching shopper expectations.

Let's personalize your content