Four actions for banks to prepare for the Open Banking wave

Accenture

AUGUST 30, 2021

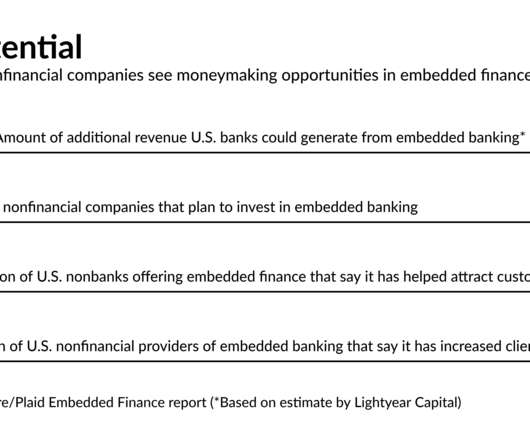

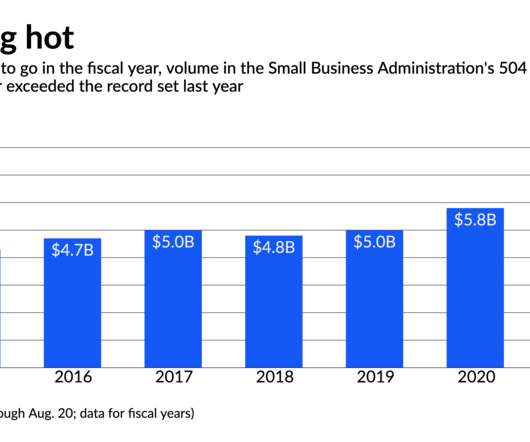

Compared with challenger banks, some traditional banks have been slow to adopt Open Banking. This is perplexing, given the potential $416-billion market opportunity Open Banking represents and the growth we expect to see over the next three years. Some banks have had understandable reasons to be hesitant about adopting Open Banking—but they won’t for much longer.

Let's personalize your content