How To Ensure Community Banks Aren’t Left Behind In The Digitization Revolution

PYMNTS

MARCH 6, 2020

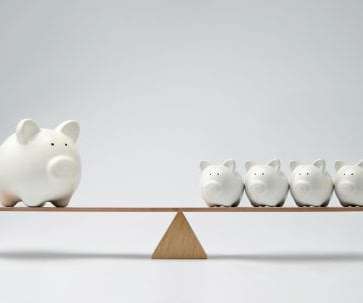

That’s even more true for community banks, which lack the resources larger FIs have to support modernization initiatives and technology investment efforts. At the same time, the logistical challenges and competitive pressures associated with digitization remain just as pertinent for community banks.

Let's personalize your content