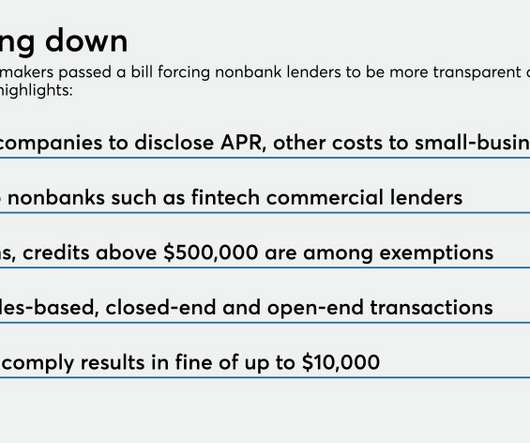

California bars unfair, deceptive practices in small business lending

American Banker

AUGUST 23, 2023

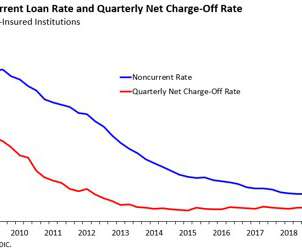

A new state regulation brings consumer-style rules to the small business realm, extending California regulators' ability to crack down on nonbank lenders that engage in questionable practices. Observers believe that it could be a model for other states.

Let's personalize your content