Themes & Takeaways From the 2022 Real-Time Payments & Fraud Management Summit

Perficient

NOVEMBER 30, 2022

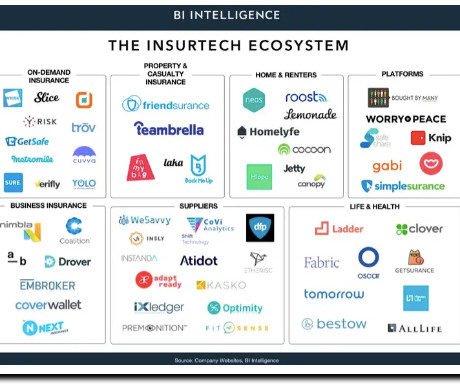

Our Payments Practice recently had the opportunity to represent Perficient at the 2022 Real-time Payments & Fraud Management Summit held in New York City. . The conference was attended by several Financial Institutions, Service Providers, Fintechs, and Industry Regulators.

Let's personalize your content