FDIC: US Banks See Chargebacks Soar, Profits Tank Due To Pandemic

PYMNTS

JUNE 17, 2020

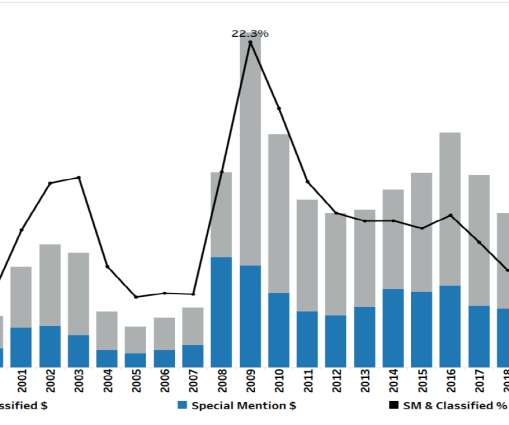

According to the Federal Deposit Insurance Corporation (FDIC), over half of all banks ended up reporting a decline in profits, and 7.3 In addition, the total number of problem banks the FDIC was watching rose for the first time since 2011, with 54 firms in the first quarter, up from 51. billion, Reuters wrote. Banks saw a $1.2

Let's personalize your content