How to Set Your Strategic Planning Time Horizon

South State Correspondent

FEBRUARY 22, 2024

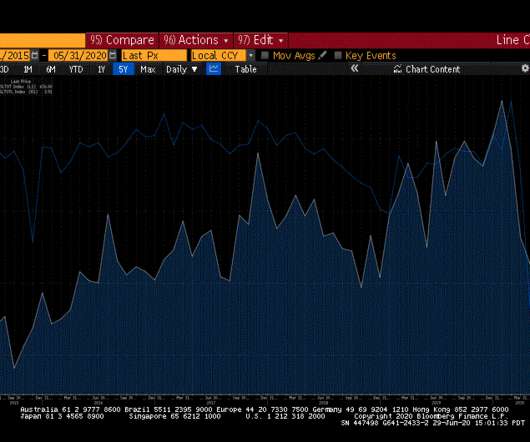

You can’t develop lending expertise overnight. A three-year time horizon isn’t long enough if say you want to take your lending platform nationally such as specializing in lending on robotics. After adjusting for risk and cost, individual securities and loans perform approximately the same.

Let's personalize your content