Give EWA a chance

Payments Dive

MAY 24, 2023

“It is unclear why critics want to place EWA in the credit silo and call for heavy-handed regulations to restrict access to EWA products,” argues the CEO of the Innovative Payments Association.

Payments Dive

MAY 24, 2023

“It is unclear why critics want to place EWA in the credit silo and call for heavy-handed regulations to restrict access to EWA products,” argues the CEO of the Innovative Payments Association.

Abrigo

MAY 24, 2023

The SAFE Banking Act could bridge the state and federal cannabis banking gap Read more for the legislation's history and how it benefits financial institutions looking to profitably bank CRBs. You might also like this whitepaper, "Cannabis and financial institutions: Providing services to cannabis-related businesses." Download now Takeaway 1 Under current federal law, banks and credit unions face federal prosecution and penalties if they provide services to legal marijuana-related businesses.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MAY 24, 2023

The Block business is seeking older, higher-income users as it pursues diversified growth, CEO Jack Dorsey said.

CFPB Monitor

MAY 24, 2023

A fintech peer-to-peer lender has entered into separate consent orders with California, Washington D.C., and Connecticut relating to its practice of requesting tips and donations in connection with the loans offered through its platform. The fintech’s platform offers opportunities for members to act as borrowers or lenders and facilitates loans between its members.

Advertisement

Discover the key benefits of portfolio loans and learn how to streamline your lending process with our infographic, "5 Things Lenders Need to Know About Portfolio Loans & Their Documentation." Find out how portfolio loans can maximize borrower potential by consolidating multiple properties under a single loan, reducing paperwork, and lowering closing costs.

Payments Dive

MAY 24, 2023

In 2015, the bank improperly denied customer reports of fraud and unauthorized use and, in some cases, failed to fully reimburse users, the CFPB said.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Jeff For Banks

MAY 24, 2023

Rafael Peralta was born April 7, 1979 in Mexico City. He graduated from San Diego's Morse High School in 1997. But he had to wait to receive his green card before he could enlist. In 2000, he received it, and on that very day he enlisted in the U.S. Marine Corps as a rifleman. He would later become a U.S. citizen while serving. In 2001, Peralta was deployed overseas when his father died in a workplace accident.

The Paypers

MAY 24, 2023

Urugay-based payments platform dLocal has announced that the Central Bank of Kenya and the National Bank of Rwanda granted dLocal their respective payment service licenses.

CB Insights

MAY 24, 2023

Y Combinator ‘s Winter 2023 batch welcomed 48 fintech startups, representing nearly a fifth of the total W23 cohort. Business-to-business (B2B) fintechs were central to its strategy — in fact, 85% of the fintechs accepted in W23 cater to businesses. While 77% of the fintech companies in the W23 cohort are based in the United States, Y Combinator also turned to emerging markets.

The Paypers

MAY 24, 2023

UK-based prepaid debit card and financial education app for kids GoHenry has partnered with Snowdrop Solutions to improve transaction location capabilities.

Speaker: Brian Muse-McKenney, Chief Revenue Officer & Matt Simester, Cards and Payments Expert

In today’s world of social media, dating apps, and remote work, businesses risk becoming irrelevant or getting "ghosted" if they fail to meet the evolving needs of Gen Z consumers. In this new webinar, Brian Muse-McKenney of Episode Six and Matt Simester of Payments Consultancy Limited will reveal key considerations banks should factor into their efforts to develop target products for the next generation of bank customers.

CB Insights

MAY 24, 2023

Apple ‘s high-yield savings account, unveiled in April through a partnership with Goldman Sachs , reached almost $1B in deposits in the first 4 days alone and 240,000 accounts in the first week. This wasn’t the first time Apple has sent waves across the fintech landscape. Since Apple’s foray into the space almost a decade ago, the company has been gradually shaping itself into a fintech giant.

BankInovation

MAY 24, 2023

Scotiabank invested in technology in the second quarter driven by project-related costs and software and licensing expenses. The Canadian bank’s tech spend in Q2 increased 13% year over year to $383 million, according to the bank’s quarterly earnings presentation.

TheGuardian

MAY 24, 2023

Traders at five banks found to have discussed British government bond trading between 2009 and 2013 The UK’s competition watchdog has provisionally found that five major banks broke competition law by unlawfully exchanging sensitive information about British government bond trading in online chatrooms. In an investigation, the Competition and Markets Authority has found that the banks – Citi, Deutsche Bank, HSBC, Morgan Stanley and Royal Bank of Canada – shared competitively sensitive informatio

BankInovation

MAY 24, 2023

Visa is launching cross-wallet transactions platform Visa+ this summer, and PayPal, Venmo and TabaPay will be among person-to-person payment apps integrated into the platform.

Speaker: Gary Dmitriev

Our upcoming webinar aims to demystify the process of selecting and implementing automation tools for financial institutes. This session will provide your roadmap for vetting potential solutions, focusing on due diligence, vendor assessments, and aligning technology with strategic goals. We’ll also address the critical issue of innovation fatigue, offering tips on maintaining enthusiasm and momentum for new initiatives.

CB Insights

MAY 24, 2023

ESG (environmental, social, and governance) investing is at a crossroads. 2022 was a year of draining flows to sustainable funds, disappointing ESG investment performance, and political backlash in the US. There are mixed reports on ESG demand and performance. However, several prominent data providers still suggest a relatively healthy market and appetite for ESG among investors.

BankInovation

MAY 24, 2023

Bank of Montreal introduced a new digital account opening program and finalized its integration of Bank of the West during the second quarter.

The Banker

MAY 24, 2023

Rising wealth inequality and booming corporate savings fuelled a ‘deposit glut’, increasing bank fragility; Silicon Valley Bank was the first victim, writes Guillaume Vuillemey.

Tomorrow's Transactions

MAY 24, 2023

Mobile first has driven the expectation of immediacy. and that has to be reflected in the payment infrastructure that supports our digital payment experience The post Real-time payments, right now, with FedNow. first appeared on Consult Hyperion.

Advertisement

Discover First Mid Bank's Expansion Success with Our Case Study! Discover how First Mid Bank & Trust fast-tracked market expansion through advanced automation and compliance solutions. This case study reveals their journey from facing challenges in Texas' complex legal landscape to achieving rapid market entry with GoDocs' innovative commercial closing platform.

The Paypers

MAY 24, 2023

Australia has planned to regulate Buy Now, Pay Later (BNPL) services as a consumer credit product, requiring providers to perform background checks prior to lending.

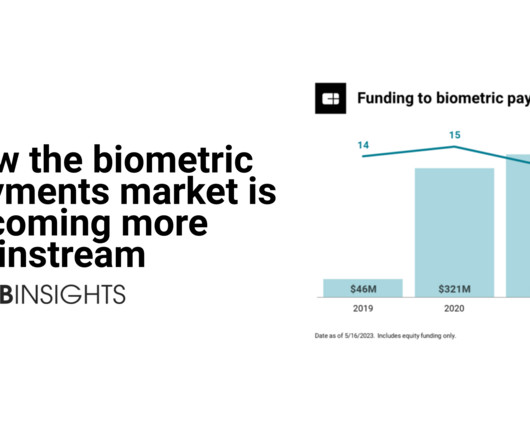

CB Insights

MAY 24, 2023

Biometric technology is revolutionizing the financial and retail sectors. Established players and innovative disruptors are embracing biometric payments — which verify and process payments using a customer’s physical features (e.g., face or palm) — to provide transactions that are more secure, efficient, and personalized. Tech giants like Apple and Google have already introduced facial recognition for payments.

The Paypers

MAY 24, 2023

India-based fintech PhonePe has received an additional USD 100 million from General Atlantic , raising the total to USD 850 million in its ongoing financing round.

Advertisement

Shifting liability for digital fraud losses represents a significant challenge for financial institutions and payment service providers. In response to the global surge in digital fraud, regulators are introducing policies that transfer the cost of fraud from defrauded customers to financial institutions. ThreatMark’s newly released white paper, "The Liability Shift: Understanding Fraud Losses Responsibility and Mitigation," provides an in-depth analysis of this shift, its implications, and stra

CB Insights

MAY 24, 2023

ESG (environmental, social, and governance) investing is at a crossroads. 2022 was a year of draining flows to sustainable funds, disappointing ESG investment performance, and political backlash in the US. There are mixed reports on ESG demand and performance. However, several prominent data providers still suggest a relatively healthy market and appetite for ESG among investors.

The Paypers

MAY 24, 2023

Payments company Thunes has partnered with Saudi Arabia-based digital bank D360 Bank to power instant cross-border payments across MENA and key global markets.

The Paypers

MAY 24, 2023

Fintech company Monese has launched its XYB banking platform, aimed to improve the way banks make financial services accessible for UK and European clients.

Advertisement

Most people dread the nearing of the month-end close and reconciliation process, and who can blame them? It's typically a tedious, long, stressful process; but it doesn't have to be. Implementing automation into your month-end process can significantly reduce this headache by automating up to 40% of your reconciliation and saving nearly 30% of your time spent.

Let's personalize your content