Your Top 3 Loan Growth Challenges – Solved

Jack Henry

OCTOBER 14, 2021

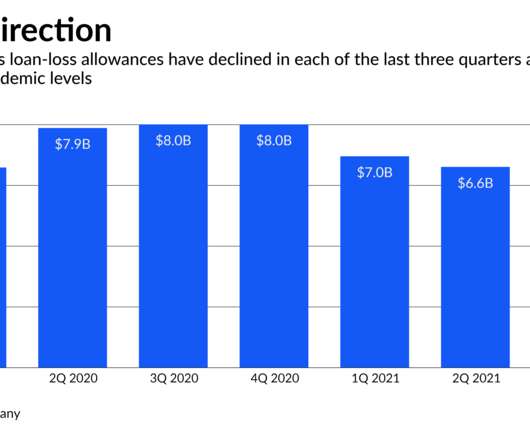

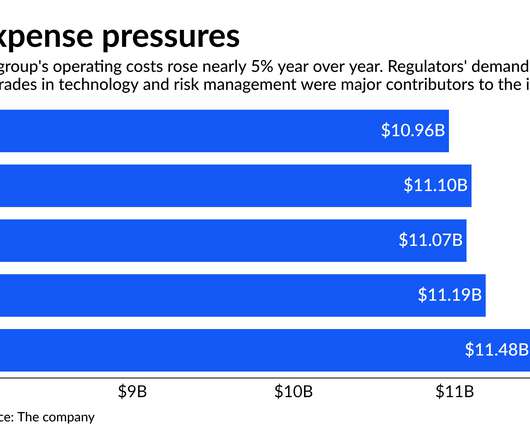

Eighteen months ago, few could have imagined the changes to our world that would occur in 2020 and 2021. The pandemic brought the most significant challenge the global economy since the great recession. This roller coaster ride has produced challenges and left bank and credit union executives wondering how to respond. What approach would meet their goals for borrower assistance, revenue generation, portfolio growth, and credit quality in the years ahead?

Let's personalize your content