Amex promotes deputy to CFO

Payments Dive

JUNE 27, 2023

When long-time American Express CFO Jeff Campbell exits in August, the company’s deputy CFO, Christophe Le Caillec, will take the top financial post.

Payments Dive

JUNE 27, 2023

When long-time American Express CFO Jeff Campbell exits in August, the company’s deputy CFO, Christophe Le Caillec, will take the top financial post.

Abrigo

JUNE 27, 2023

Key Takeaways Real estate markets are vulnerable to money laundering and fraud because of their transaction size and appreciation over time. Regulations such as Geographic Targeting Order updates help identify AML risks by requiring identification for certain real estate purchases. Institutions should stay current on any regulatory changes, including GTO updates, and train staff to recognize red flags.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JUNE 27, 2023

The buy now, pay later trend faces a starkly different environment than the one in which it gained traction. Regulation looms, the economy has worsened and investors are demanding profits. It’s all a test of BNPL’s long-term footing.

CFPB Monitor

JUNE 27, 2023

The U.S. Department of Housing and Urban Development (HUD) recently announced in Mortgagee Letter 2023.13 that lenders must use the Supplemental Consumer Information Form (SCIF) of Fannie Mae and Freddie Mac in connection with FHA insured mortgage loans with application dates on or after August 28, 2023. As previously reported , in May 2022 the Federal Housing Finance Agency announced that for residential mortgage loans to be sold to Fannie Mae or Freddie Mac with application dates on or after M

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

JUNE 27, 2023

The coffee retailer was only able to accept cash and Starbucks App payments on Monday during a company-wide technology snafu.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

BankUnderground

JUNE 27, 2023

Danny Walker Many people expect the rise in interest rates over the past 18 months to lead house prices to fall. Average prices have already fallen by 1–2% in the UK and by more in the US. In this post I show that historically there have been large differences in how an interest rate shock affects prices in different areas of the country, even though interest rates are determined nationally.

TheGuardian

JUNE 27, 2023

The head investor of Norway’s sovereign wealth fund worries more about AI affecting the country’s portfolio than his own collection of paintings For a prolific art collector, Nicolai Tangen is remarkably relaxed about the prospect of masterpieces created by robots. The threat of AI-made paintings, impossible to distinguish from human brushstrokes, has sparked soul-searching and paranoia in the art world , but not with Tangen.

American Banker

JUNE 27, 2023

Industry leaders cautioned the National Credit Union Administration against drafting new regulations to address the financial risks associated with climate change.

BankInovation

JUNE 27, 2023

Financial institutions can look to data to create hyper-personalized experiences within back- and front-end operations — if they prioritize data and analytic literacy throughout their institutions.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

American Banker

JUNE 27, 2023

The fintech's revenue has soared as interest rates jump to contain inflation. CFO Matt Briers discussed the firm's strategy to navigate the inevitable decline.

TrustBank

JUNE 27, 2023

Investing is a powerful tool that helps reach financial goals and grow wealth over time. Investors have historically tried to measure the success or failure of their investments by comparing performance to market-based benchmark indices, such as the MSCI All Country World Index, S&P 500 Index, Bloomberg Government/Credit Intermediate Bond Index, 90 Day U.S.

FICO

JUNE 27, 2023

Home Blog FICO UK Cards: Spend and Balances Rose in March / April 2023 Unpredictable consumer spending puts banks on high alert as deadline for new Consumer Duty Guidance nears Thu, 02/09/2023 - 08:37 Pawel Pasik by Liz Ruddick Principal Consultant expand_less Back to top Tue, 06/27/2023 - 15:45 How are consumers in the UK managing their finances in a period of high inflation and interest rates?

BankInovation

JUNE 27, 2023

Financial institutions can look to data to create hyper-personalized experiences within back- and front-end operations — if they prioritize data and analytic literacy throughout their institutions.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

American Banker

JUNE 27, 2023

The allegation that Binance encouraged the use of location-obscuring technology so that it could illegally serve U.S. clients is a symptom of a broader problem for financial services companies.

The Paypers

JUNE 27, 2023

The government of Venezuela has announced that it plans to integrate Mir , a Russian electronic card and transfer payments system.

American Banker

JUNE 27, 2023

About 90% of surveyed bankers said cybersecurity was their biggest worry, ahead of legacy tech and talent shortage issues.

The Paypers

JUNE 27, 2023

CaixaBank has rolled out FXWallets, a service for opening virtual accounts with no opening or maintenance costs, to send and receive international payments in multiple currencies.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

American Banker

JUNE 27, 2023

Bankers, traders and support staff in Credit Suisse's investment bank in London, New York and in some parts of Asia are expected to bear the brunt of the cuts, with almost all activities at risk, people familiar with the matter said.

The Paypers

JUNE 27, 2023

Netherlands-based payment service provider PayU has added two new payment methods, Mastercard Click to Pay and Capitec Pay, to increase conversion for South African merchants.

American Banker

JUNE 27, 2023

A report from the Treasury Department's Federal Insurance Office urges state regulators to spruce up their toolkits for monitoring and mitigating the impact of climate change on homeowners insurance.

The Paypers

JUNE 27, 2023

Digital transformation, agile development, and intelligent automation services provider Endava has partnered with insurance payments platform Imburse , a Duck Creek Technologies company.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

American Banker

JUNE 27, 2023

Bank of America says it will extend its branch footprint to Omaha, Dayton and Huntsville. The moves are part of an ongoing strategy to enter new markets even as the bank reduces its total branch count.

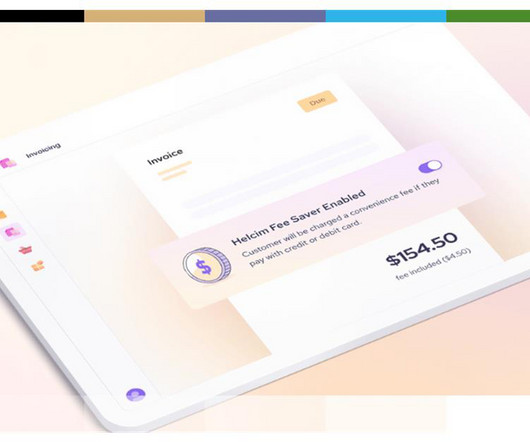

The Paypers

JUNE 27, 2023

Canada-based payment service provider Helcim has rolled out ‘Helcim Fee Saver’ to reduce payment processing fees for merchants and navigate surcharging and convenience fees.

American Banker

JUNE 27, 2023

The bank hasn't managed debt sales in Texas since a measure took effect in 2021 that bars governmental entities from working with companies that "discriminate" against firearms businesses. BofA's "current risk-based framework and policies" can comply with that law, a lawyer for the bank has told the state.

The Paypers

JUNE 27, 2023

The Bank of Lithuania has revoked the licence of the electronic money institution UAB PAYRNET for serious, systematic, and multiple violations of legal acts.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content