Upstart rakes in $194 million in quarterly revenue

BankInovation

AUGUST 11, 2021

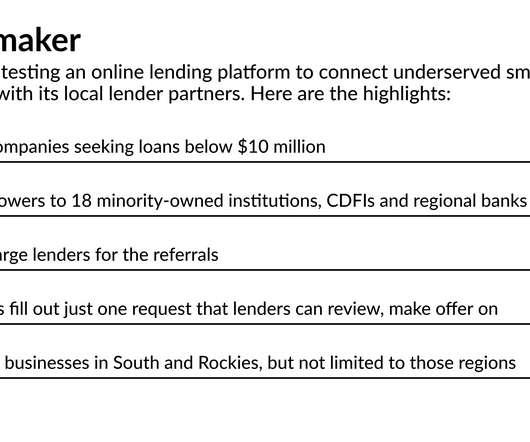

AI-powered online lending platform Upstart earned $194 million in quarterly revenue denoting a growth of 60% on a quarterly basis, according to the firm’s earnings report released Tuesday. The Upstart Referral Network uses AI to helps match loan applicants with banks and credit unions, and has been deployed by financial institutions like the $9.9 billion […].

Let's personalize your content