AML Quality Control: Strong QC Can Prevent BSA Violations

Abrigo

JANUARY 3, 2022

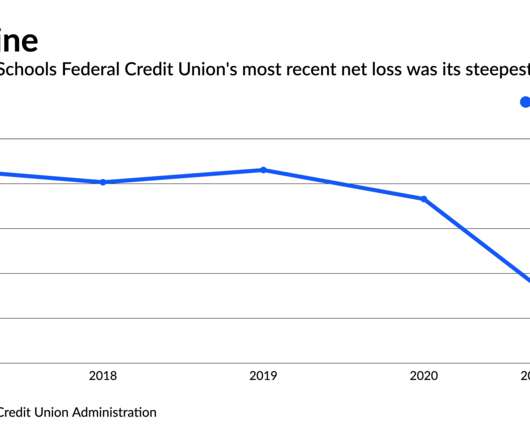

Tips to strengthen financial institution BSA/AML quality control AML quality control helps financial institutions make certain that suspicious activity monitoring meets program expectations. . Have you combined your BSA & Fraud Departments, or are you considering it? You might like this webinar. WATCH. Takeaway 1 Recent fines against a bank in Texas remind financial institutions of the importance of AML quality control.

Let's personalize your content