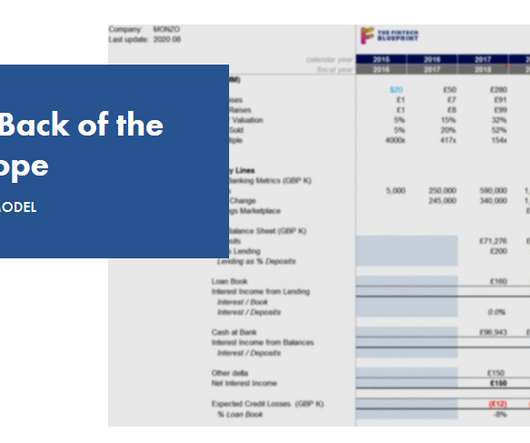

The rise of Monzo, Revolut, and Starling and a comparison of Facebook and Whatsapp

Lex Sokolin

AUGUST 19, 2020

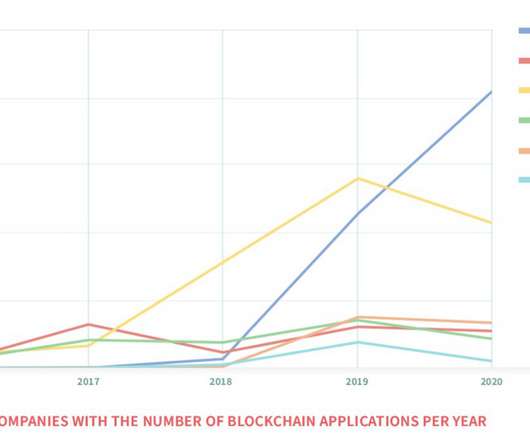

The results say more about consumer Fintech investing than about any company in particular. Next came the arithmetic of how much these companies raised, and how together they have 15 million users and $10 billion of European Fintech unicorn enterprise value. People just might switch phone brands for Facebook.

Let's personalize your content