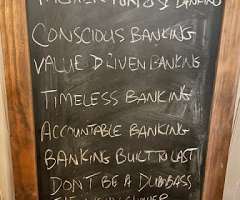

If You Are Tired of Being Transactional, You Need A Hedge Program

South State Correspondent

APRIL 30, 2024

Community banks’ main goals are to diligently support their local communities and make an acceptable return on capital in these challenging times. We witness over and over how some banks get themselves in deeper trouble booking derivatives on their books that are bets on market interest rate movements.

Let's personalize your content