Community Bank Outlook: Challenges and Opportunities in 2021 and Beyond

Abrigo

AUGUST 6, 2021

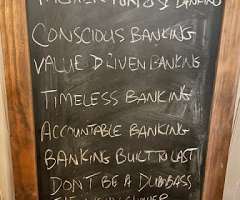

How can community financial institutions thrive in 2021? Community banks provide unique and important banking services for their customers, but they also face significant obstacles. Would you like other articles like this in your inbox? Takeaway 2 Community banks are at a crossroads: innovate or be left behind (or acquired).

Let's personalize your content