Google Pay adds card reward details to checkout

Payments Dive

MAY 22, 2024

American Express and Capital One cardholders can now see what rewards they would earn from purchases when checking out with Google Pay, the tech giant said in a blog post.

Payments Dive

MAY 22, 2024

American Express and Capital One cardholders can now see what rewards they would earn from purchases when checking out with Google Pay, the tech giant said in a blog post.

South State Correspondent

MAY 22, 2024

Between now and the end of 2027, it is estimated that $2.2T of office loans is coming due. Much of this product lies on banks’ balance sheets. A high percentage of those office loans on banks’ balance sheet are balloon structures where the bulk of the loan’s principal is due. Equally worrisome is the large number of loans on banks’ balance sheets that are due for a rate reset where the interest rate will be almost double, thereby putting stress on borrowers.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MAY 15, 2024

Concerns about the $35B merger proposal, which has already faced opposition, are likely to surface again at the July public meeting.

BankInovation

MAY 20, 2024

JPMorgan Chase considers customer needs, competition and time to market when approaching product launches for small-business clients. “We really try to keep the small-business owner at the center of all of that innovation process at Chase for Business,” Jameson Troutman, head of product for small business at JPMorgan Chase, told Bank Automation News.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Gonzobanker

MAY 16, 2024

Digital metrics at banks and credit unions are not all trending up and to the right. But there are some bright spots. A new report on digital banking metrics and the impact that digital banking is having on banks reveals some positive developments, but also a host of troubling trends that should give bank executives cause for concern. The fourth edition of the Digital Banking Performance Metrics study from Cornerstone Advisors, commissioned by Alkami, captures digital banking metrics from banks

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

MAY 21, 2024

“Whether a shopper swipes a credit card or uses Buy Now, Pay Later, they are entitled to important consumer protections under longstanding laws and regulations,” CFPB Director Rohit Chopra said.

South State Correspondent

MAY 15, 2024

Bankers have been taught to diversify their loan portfolio to reduce idiosyncratic (individual borrower) risk and to stabilize earnings. The thinking is that diversification-induced lending leads to banking resiliency. We believe that while lending diversification leads banks to lend more in normal times (especially for banks over $50B in assets) and does benefit the general economy, community banks should be careful in how and where they choose to diversify.

BankInovation

MAY 17, 2024

Small business clients looking to make data-driven business decisions within their operations don’t always know how to tap into their data, but JPMorgan Chase has created a solution to deliver these insights.

TheGuardian

MAY 21, 2024

While the big beasts of Wall Street rail against WFH, Mike Regnier of Santander UK says he wouldn’t have taken the job if he had had to commute all week At a time when banking bosses from Wall Street to Canary Wharf have been cracking down on working from home, Santander UK’s chief executive remains an outlier. While Goldman Sachs’s David Solomon has described home working as an “aberration” , and JP Morgan’s Jamie Dimon calls himself a “skeptic” of the trend that took off during the pandemic,

Advertisement

Dive into the complexities of New York lien laws with our comprehensive eBook, 'New York Lien Law Essentials: 5 Key Facts for Commercial Lenders.' In this detailed guide, we explore the critical formalities necessary for lenders navigating ground-up construction and fix-and-flip projects in the New York market. From documentation requirements to the implications of non-compliance, learn how to safeguard your lending position and prioritize legal adherence.

Commercial Lending USA

MAY 17, 2024

One of the largest companies that offers business loans is Commercial Lending USA. You can get money from them to help your business grow and stay ahead of the competition.

South State Correspondent

MAY 15, 2024

Bankers have been taught to diversify their loan portfolio to reduce idiosyncratic (individual borrower) risk and to stabilize earnings. The thinking is that diversification-induced lending leads to banking resiliency. We believe that while lending diversification leads banks to lend more in normal times (especially for banks over $50B in assets) and does benefit the general economy, community banks should be careful in how and where they choose to diversify.

BankInovation

MAY 15, 2024

AI and generative AI applications continue to dominate conversations within the financial services industry, but implementing generative AI is near impossible if bank data isn’t standardized and accessible. What makes good data?

ATM Marketplace

MAY 17, 2024

The future of ATMs lies not as machines that just dispense cash, but rather as multifunctional banking kiosks,

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

Jack Henry

MAY 16, 2024

Soon, we will be back to “normal,” or at least something that resembles it. Promising vaccines are on the horizon. In some states, businesses are reopening. Holiday shopping is even underway. At the same time, millions of US-based businesses are preparing for 2021 and what it may bring. Through the sharp second quarter decline, many industry sectors saw gross revenues drop by more than 40%.

Payments Dive

MAY 15, 2024

The payments processing company plans to incorporate Revel’s point-of-sale capabilities into its SkyTab POS system, Shift4 CEO Jared Isaacson said.

Cisco

MAY 15, 2024

The Digital Operational Resilience Act (DORA) offers financial service institutions the chance to enhance operational resilience and competitive advantage through compliance, with Cisco providing a comprehensive suite of solutions to support FSIs in meeting these new regulatory requirements.

The Paypers

MAY 20, 2024

Spain-based Santander , in collaboration with Iberpay , has announced that it processed one of the first instant transfers based on the EPC’s OCT Inst scheme.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

ATM Marketplace

MAY 21, 2024

ATM Marketplace spoke with Bank of America about the Erica chatbot and its continued development as an AI banking tool.

Jack Henry

MAY 16, 2024

FASB’s Accounting Standards Update (ASU) No. 2016-13 (more commonly referred to as CECL) was released earlier this year in June. At first look, the implementation dates for CECL are so far out that this project may not rank very high on a management team’s to-do list. Public business entities (PBEs) that are SEC registered have a regulatory reporting effective date March 31, 2020.

Payments Dive

MAY 21, 2024

The fledgling U.S. instant payments system can learn from real-time systems that have flourished in Brazil and India using QR codes and broad missions, say industry professionals.

American Banker

MAY 15, 2024

As part of a sweeping digital enhancement of its consumer payment cards, Visa will enable banks to issue an account as a credit, debit, virtual or Pay in 4 installment loan, based on the user's preference at the time of purchase.

Advertiser: Data Robot

The buzz around generative AI shows no sign of abating in the foreseeable future. Enterprise interest in the technology is high, and the market is expected to gain momentum as organizations move from prototypes to actual project deployments. Ultimately, the market will demand an extensive ecosystem, and tools will need to streamline data and model utilization and management across multiple environments.

BankInovation

MAY 22, 2024

JPMorgan Chase has identified three uses for generative AI to boost efficiency. “AI, and particularly large language models, will be transformational,” Chief Operating Officer Daniel Pinto said during the bank’s Investor Day on May 20, noting that the bank has been investing in AI for “a number of years.” The $3.

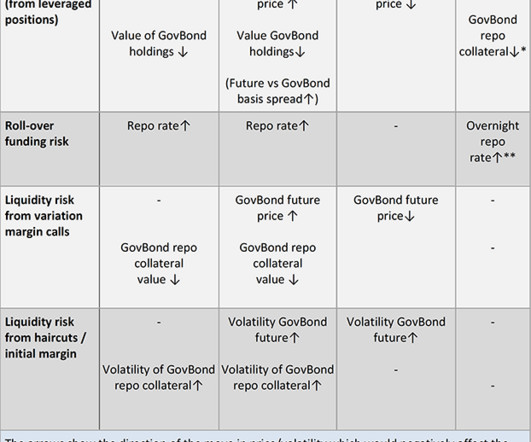

BankUnderground

MAY 16, 2024

Adam Brinley Codd, Daniel Krause, Pierre Ortlieb and Alex Briers We both drive cars, but the US drives on the right while the UK drives on the left. We both walk, but we do so on sidewalks in the US and pavements in the UK. We both have asset managers, who want to take leveraged positions in interest rates. US asset managers had around US$650 billion of long treasury futures in June 2023.

Realwired Appraisal Management Blog

MAY 22, 2024

Appraisers undervalue their worth. The bank C-Suite is largely unaware of the market knowledge depth of their own appraisal department. Their approved appraiser vendors are top-notch. Both are integral to the stability of the real estate industry.

Payments Dive

MAY 21, 2024

Mastercard has set its sights on expanding in China, Japan and elsewhere, Michael Miebach said in spelling out the company’s worldview. Last year, the company drew two-thirds of revenue from outside North America.

Advertisement

Most people dread the nearing of the month-end close and reconciliation process, and who can blame them? It's typically a tedious, long, stressful process; but it doesn't have to be. Implementing automation into your month-end process can significantly reduce this headache by automating up to 40% of your reconciliation and saving nearly 30% of your time spent.

Let's personalize your content