The 2022 GonzoBanker Awards

Gonzobanker

DECEMBER 19, 2022

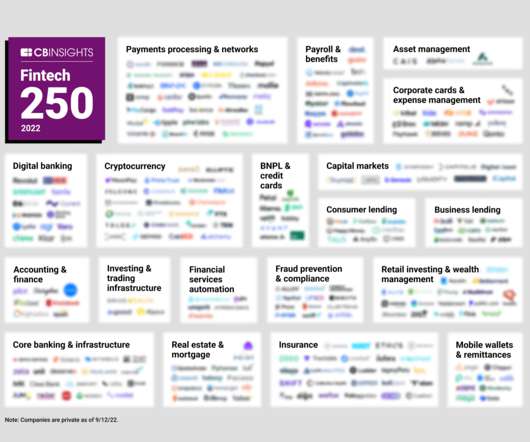

Who saw 2022 coming and accurately predicted the headlines? A few modest examples of the 2022 roller coaster ride: The Fed rate hikes in 2022 totaled 425 basis points. In 2021, there were more than 120 fintech IPOs in the U.S., In 2022, there was… wait for it… exactly one. Goes to 2022. OK, show of hands.

Let's personalize your content