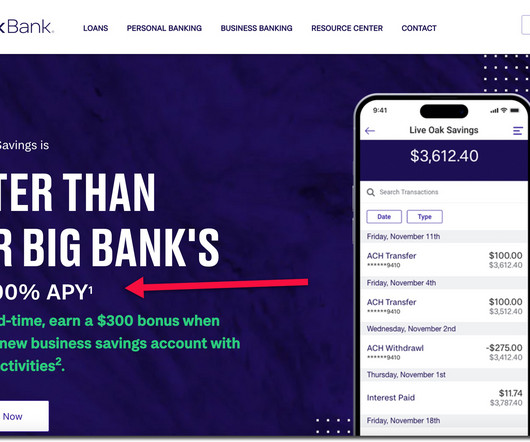

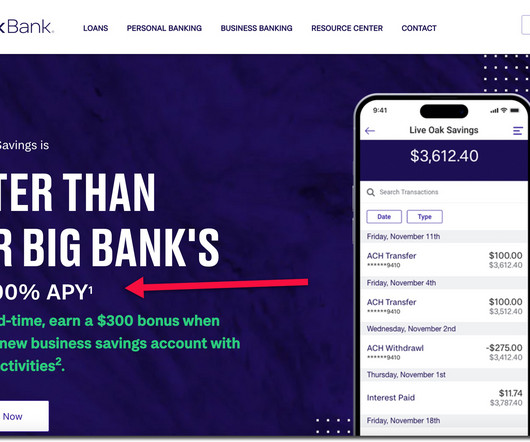

FDIC Proposed Rule and Information Requests Target False Advertising, Use and Misuse of FDIC Name and Logo

CFPB Monitor

MAY 19, 2021

The Federal Deposit Insurance Corporation (FDIC) recently issued a notice of proposed rulemaking (NPR) and request for information (RFI) addressing “False Advertising, Misrepresentation of Insured Status and Misuse of the FDIC’s Name or Logo”.

Let's personalize your content