The declining elasticity of US housing supply

BankUnderground

FEBRUARY 25, 2020

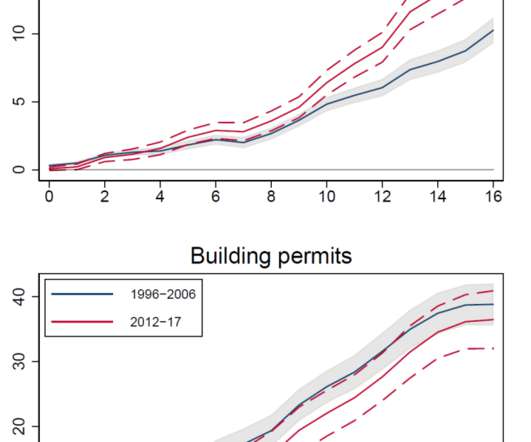

We find that US housing supply has become less elastic since the crisis, with bigger declines in places where land-use regulation has tightened the most, and in areas that had larger price declines during the crisis. The 1996-2006 boom vs the 2012-2017 recovery. during 2012-17. during the 1996-2006 housing boom, to 1.75

Let's personalize your content