Do large and small banks need different prudential rules?

BankUnderground

AUGUST 10, 2021

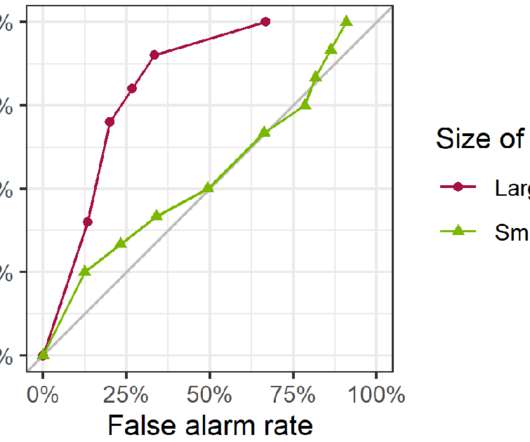

Do prudential regulations that work well for big banks work as well for small ones? This provides evidence that an efficient set of regulations for large banks might not be as efficient for small ones. Regulators would then need to think about whether a different set of regulatory requirements would be better for small banks.

Let's personalize your content