B2B FinTechs Diversify Funding Strategies With M&A, IPOs

PYMNTS

NOVEMBER 22, 2019

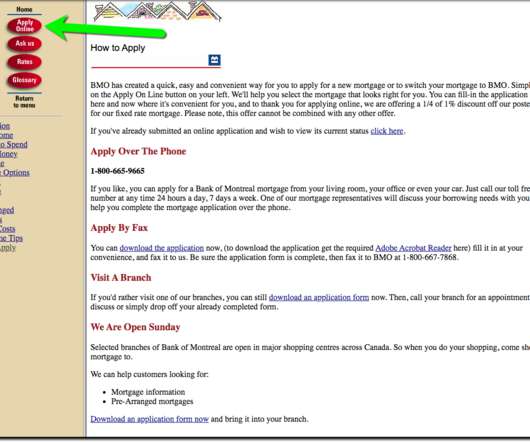

Talk of a decelerating FinTech venture capital market continued to mount this week with reports that digital banking startup Aspiration is struggling to raise money. Venture Capital Funding. raised $10 million from SEB Bank and Seed Capital for its commercial card technology. Cardlay, based in the U.K., Also in the U.K.,

Let's personalize your content