Is commercial lending on the rise?

Independent Banker

APRIL 30, 2022

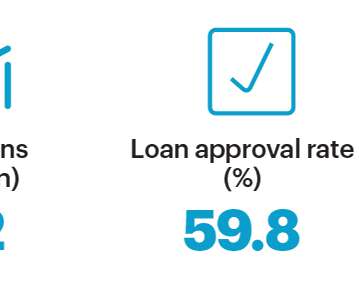

Loan providers share an infectious enthusiasm and growing optimism for one vertical’s prospects in 2022: commercial lending. Here’s how community bankers can take advantage of various sectors—including SBA lending—over the next 12 months. anticipates a low double-digit increase in its commercial lending in 2022. Quick Stat.

Let's personalize your content