Building your growth plan: Key metrics to consider - Part 3

Abrigo

OCTOBER 11, 2016

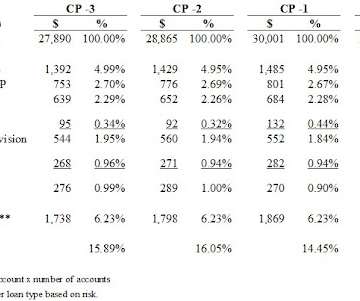

While increasing the volume of qualified loan applications is an important component of any growth strategy, leadership at these institutions may not consider that there are ample opportunities already available in their loan application pool. This practice is designed to mitigate risk, but it can also limit lending opportunities.

Let's personalize your content