Ramp jumps into cross-border payments

Payments Dive

SEPTEMBER 9, 2022

The fintech startup is adding services as it targets a bigger bite of the $120 trillion business-to-business payments market.

Payments Dive

SEPTEMBER 9, 2022

The fintech startup is adding services as it targets a bigger bite of the $120 trillion business-to-business payments market.

Accenture

SEPTEMBER 9, 2022

So far, in this series of blogs on the evolution of banking operations for the digital era, we’ve looked firstly at how banks can gain competitive advantage from bringing ops and tech closer together and then at how operations can help design and deliver compelling digital experiences for customers. In this third instalment, we home…. The post How can banking ops help increase productivity appeared first on Accenture Banking Blog.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

South State Correspondent

SEPTEMBER 9, 2022

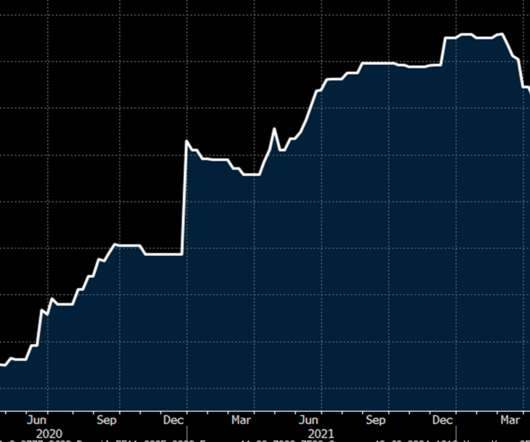

Inflation Trends Look Positive. Treasuries are well bid this morning after reacting negatively to Fed Chair Powell’s Cato conference comments yesterday that didn’t retreat from any of the hawkishness of Jackson Hole. Treated negatively yesterday, this morning the Treasury rally is being explained as “investors feeling rate hikes are getting close to being fully priced in.

Payments Dive

SEPTEMBER 9, 2022

The tech behemoth invested another $5 million in Black entrepreneurs, including some that have founded firms in the payments arena.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

SWBC's LenderHub

SEPTEMBER 9, 2022

In season four of Stranger Things, Eleven and the crew battle an ambiguously undead supervillain and his cadre of squelching vines and vampiric bats in the Upside Down to save the world.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

BankInovation

SEPTEMBER 9, 2022

Revolut Ltd. is launching a one-click payment feature in a bid to rival PayPal Inc. and other tech giants at online checkouts. Revolut Pay has signed up retailers including Shopify Inc., Prestashop, WH Smith Plc and Funky Pigeon, and will be available within the airline industry in the coming months, according to a statement from […].

The Paypers

SEPTEMBER 9, 2022

UK-based remittance platform Wise has launched SWIFT Receive service, so customers from banks can receive cross-border payments, even if the bank is not connected to SWIFT.

BankInovation

SEPTEMBER 9, 2022

Verimore Bank, formerly First Missouri Bank, recently underwent a complete core conversion that focused on enhanced digital offerings and in August rebranded to better reflect its ability to deliver advanced technology services. The $377 million Missouri-based community bank is now able to provide tech-focused mobile and business banking “a little more seamlessly,” Chief Executive Kristie […].

The Paypers

SEPTEMBER 9, 2022

YouGov and TrueLayer have published a research showing that the majority of people would still use subscriptions if they were easier to cancel and manage.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

BankInovation

SEPTEMBER 9, 2022

Open finance API platform Belvo announced that it has received an investment from Citi Ventures to expand its footprint into Latin American countries. The amount of capital invested was not disclosed. Sao Paulo, Brazil-based Belvo has raised a total of $56 million over six funding rounds. The fintech’s collaboration with Citi Ventures will help facilitate […].

The Paypers

SEPTEMBER 9, 2022

Global fintech specialised in embedded finance orchestration solutions, Zai , has joined a strategic partnership with TerraPay , a global payments infrastructure company to enhance scalability.

BankInovation

SEPTEMBER 9, 2022

Over the last decade, neobanks and fintechs have established themselves as key players in the financial industry, with more customers than ever before choosing their services over traditional banks. As the pace of change quickens and competition heats up, partnerships between banks and fintechs are becoming increasingly sought after. At Wise Platform, we work with […].

The Paypers

SEPTEMBER 9, 2022

Bitcoin has managed to surge past the USD 20.000 barrier and is eyeing its best day in six weeks on Friday 09.09.2022, with no particular triggering event, as the USD fells broadly.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

American Banker

SEPTEMBER 9, 2022

The Paypers

SEPTEMBER 9, 2022

Eleven authorised deposit-taking institutions have signed with data intermediary Adatree to access Open Banking data as Consumer Data Right representatives, according to Banking Day.

The Paypers

SEPTEMBER 9, 2022

US-based payments platform Square has partnered with UK-based payroll technology provider Sage in order to help small businesses take more control of their finances.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Paypers

SEPTEMBER 9, 2022

Nubank , a Brazil-based neobank, has joined Open Finance, a Central Bank system allowing institutions to share among themselves customers’ financial data.

The Paypers

SEPTEMBER 9, 2022

Allied Bank has selected BPC to enable digital payment acceptance as a Merchant Acquirer to contribute toward expansion of digital payments ecosystem.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

SEPTEMBER 9, 2022

UK-based identity verification platform ComplyCube has improved the accuracy and success rate of its document verification service for Arabic IDs.

American Banker

SEPTEMBER 9, 2022

The Paypers

SEPTEMBER 9, 2022

Insurance company Allianz Trade has teamed up with French fintech Pledg to create a Buy Now, Pay Later solution for B2B ecommerce websites.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content