Why payments will be forced to innovate in 2022

Accenture

FEBRUARY 18, 2022

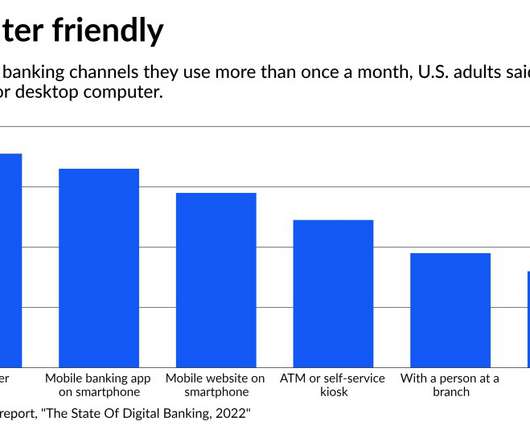

The payments space has surely seen more than its fair share of disruption in the last decade. The advent of service providers like Square, Venmo, Alipay and PayPal has rewritten customer expectations around sending and receiving money. The response of payments incumbents to compete with these new offerings has pushed the industry yet further. Customers….

Let's personalize your content