A Bank Automation Summit Preview: Key 2023 Banking Automation Trends

Perficient

FEBRUARY 22, 2023

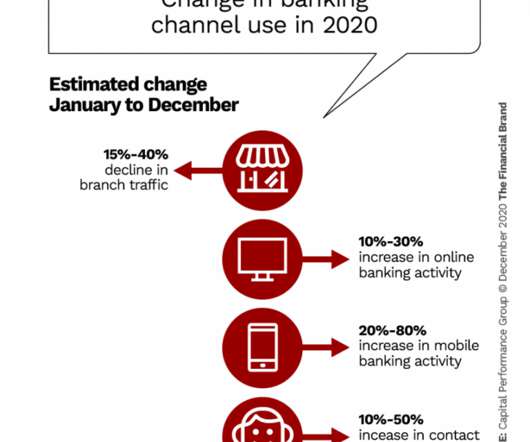

Perficient is looking forward to bringing our unique combination of automation technical know-how along with financial services and payments industry expertise to the Banking Automation Summit in Charlotte, North Carolina on March 2-3. Next, we’re observing a continuously increased focus on customer experience.

Let's personalize your content