FDIC Quarterly highlights community bank performance in manufacturing states

ABA Community Banking

JULY 21, 2022

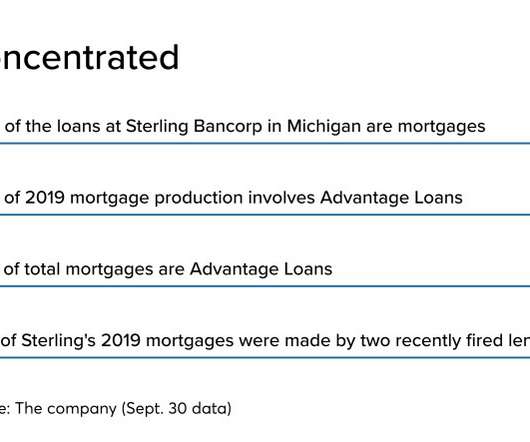

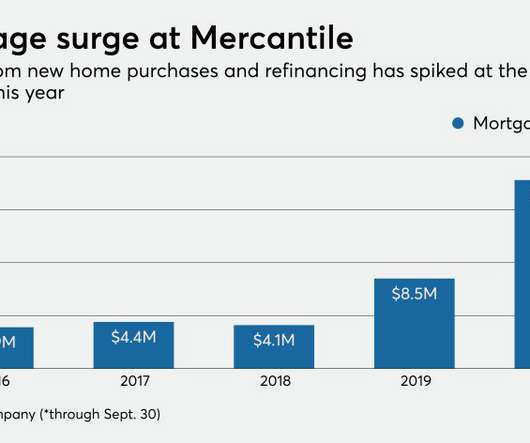

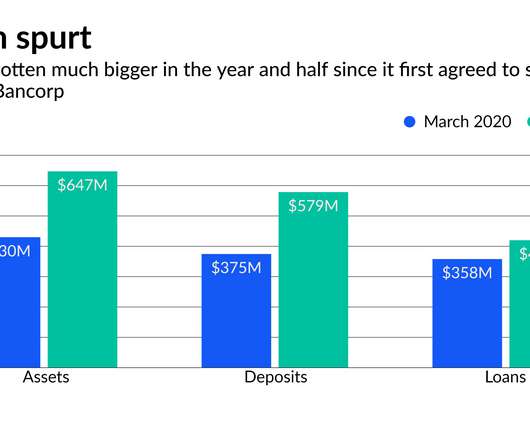

The latest issue of the FDIC Quarterly explores loan performance at community banks in five manufacturing-concentrated states: Indiana, Kentucky, Louisiana, Michigan and Wisconsin. The post FDIC Quarterly highlights community bank performance in manufacturing states appeared first on ABA Banking Journal.

Let's personalize your content