At home with HOA banking

Independent Banker

JUNE 30, 2022

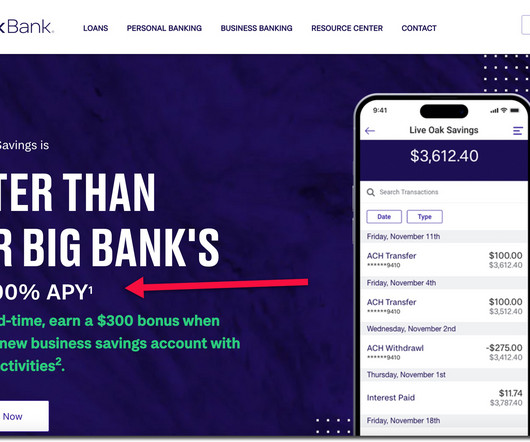

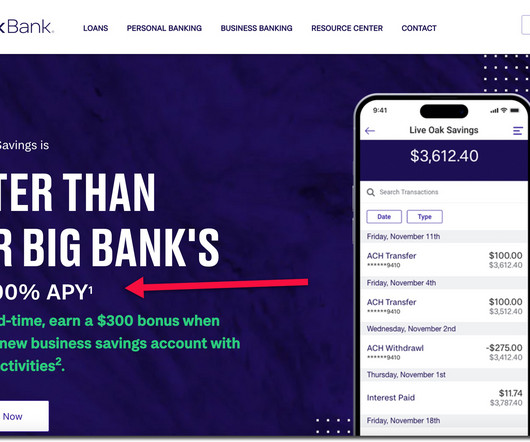

It provides a wide range of financial solutions for business and individuals, including commercial and business banking, treasury management, and mortgage services. They include everything from low-cost HOA checking and high-earning money market accounts to treasury management products. Two bank charters (which doubles FDIC coverage).

Let's personalize your content