Community bank, fintech team up to serve gig-economy workers

American Banker

AUGUST 10, 2020

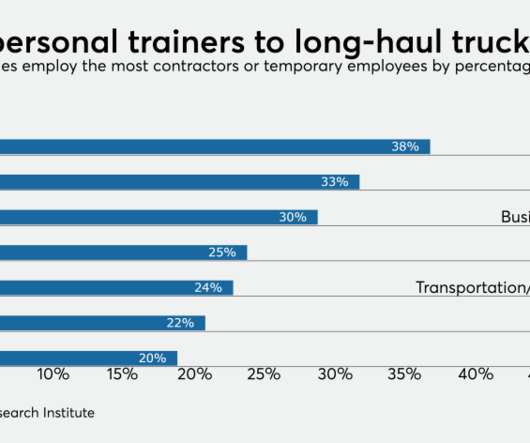

Somerset Trust in rural Pennsylvania has partnered with RoamHR, a financial platform that assists the self-employed, to add tax-withholding help for contract and temporary workers to the bank's services.

Let's personalize your content