Acquire or Be Acquired 2024: A Race to Perform … and Earn the Right to Transform

Gonzobanker

FEBRUARY 1, 2024

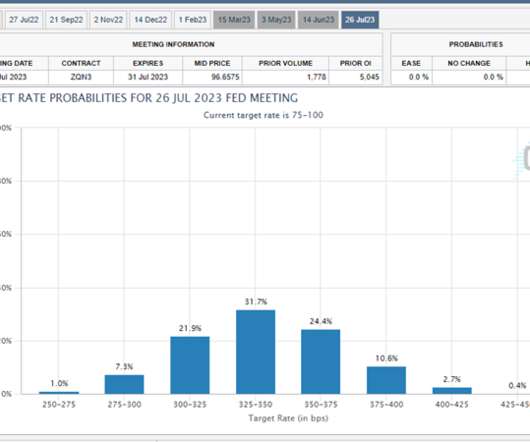

Our just-released What’s Going On In Banking 2024 research authored by Ron Shevlin reveals that cost of funds is the top concern for 70% of banks and credit unions this year, and deposit gathering was in the top four for half of both groups. Well, we’re in 2024 and let’s talk about that “promising outlook” that seems to be building toward Q3.

Let's personalize your content