Startup Metropolis snags $167M to scale

Payments Dive

JUNE 15, 2022

Metropolis Technologies, which uses computer vision and machine learning for parking payments, plans to use the funding to scale, aiming to hire 500 workers by the end of the year.

Payments Dive

JUNE 15, 2022

Metropolis Technologies, which uses computer vision and machine learning for parking payments, plans to use the funding to scale, aiming to hire 500 workers by the end of the year.

Accenture

JUNE 15, 2022

Credit card receivables & purchase volume YoY growth: 1Q22 Click/tap on image to enlarge. 1 Average Receivables in Billions. Note: Citi inclusive of both Branded and Retail Services. AXP is Revolving only. SYF A/R is Retail Card, NCL is total company. Earnings call commentary Growth “Spending growth was led by the acceleration of volumes from….

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JUNE 15, 2022

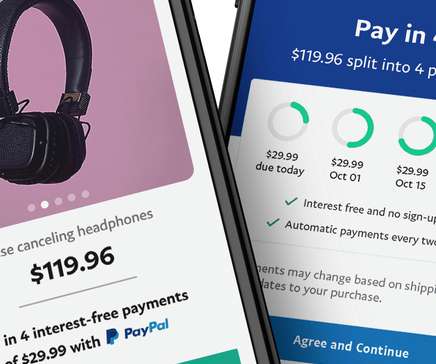

PayPal is making a bigger move into buy now-pay later financing as competitors in that arena multiply. It will now offer a new monthly payment plan targeted at bigger purchases.

South State Correspondent

JUNE 15, 2022

Treasuries Finally Find a Bid. On Fed Day, Treasuries are finally finding a bid as news that the ECB convened an emergency meeting added a flight-to-safety bid into the Treasury market. The ECB is worried that some of its peripheral members are seeing yield spreads significantly widen as they prepare to hike rates and that could threaten financial stability.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

JUNE 15, 2022

Apple's entry into the buy now-pay later market isn't a concern for Affirm, the company's Chief Financial Officer Michael Linford asserted Tuesday.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

JUNE 15, 2022

Food delivery company GrubHub will make an instant payout option available to its couriers, with an assist from PayPal and Visa, so drivers can deposit earnings to a debit card.

BankInovation

JUNE 15, 2022

PayPal Holdings Inc. is pushing deeper into the rapidly expanding “buy now, pay later” arena by offering installment loans for larger purchases. Consumers will be able to make monthly payments on purchases of $199 to $10,000 for as long as two years, PayPal said in a statement. Annual percentage rates on the loans could reach […].

TheGuardian

JUNE 15, 2022

‘Net zero’ global alliance of financial institutions, begun at Cop26, can still invest in coal and other fossil fuels Banks that have signed up to a global climate pledge, led by Mark Carney , a former governor of the Bank of England, can still invest unlimited amounts in coal mining and coal power, despite promises to tighten the rules on their lending.

BankInovation

JUNE 15, 2022

Green Dot is in the midst of a technology transformation that it estimates will save the digital bank $35 million annually by 2024. The shift will have the banking fintech owning its own tech stack and banking-as-a-service (BaaS) platform, said Amit Parikh, executive vice president of BaaS at Green Dot. “It is a big change,” […].

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

CFPB Monitor

JUNE 15, 2022

The California Department of Financial Protection and Innovation (DFPI) has issued proposed regulations to implement provisions of the California Consumer Financial Protection Law (CCFPL) pertaining to consumer complaints and inquiries. Comments are due by July 5, 2022. Specifically, the CCFPL requires the DFPI to issue rules establishing reasonable procedures for responding to consumer complaints against and inquiries concerning a “covered person” and rules requiring covered persons to provide

TheGuardian

JUNE 15, 2022

Wall Street braces for borrowing-cost rise not just next month but in September too as 8.6% rise in annual inflation spurs on central bank The ghost of Paul Volcker is haunting Washington today after the US Federal Reserve announced it was stepping up the fight against inflation with an aggressive 0.75 percentage point increase in interest rates. Four decades ago – the last time the annual increase in the American cost of living was higher than its current 8.6% – Volcker became legendary as the

CFPB Monitor

JUNE 15, 2022

The California Department of Financial Protection and Innovation (DFPI) has issued final regulations to implement SB 1235, the bill signed into law on September 30, 2018 that requires consumer-like disclosures to be made for certain commercial financing products, including small business loans and merchant cash advances. . SB 1235, codified at CA Financial Code (Code) sections 22800-22805, requires a “provider,” meaning a person who extends a specific offer of “commercial financing” as defined i

The Paypers

JUNE 15, 2022

Advanced Fraud Solutions (AFS) , a provider of payments fraud detection, has announced an agreement with Fiserv , a provider of payments and financial services technology.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

BankInovation

JUNE 15, 2022

Core provider Thought Machine’s automated cloud-native payment platform for banks is live after 18 months of development. Vault Payments was developed specifically for banks and financial institutions and operates with Mastercard-supported card-issuing and -processing. The platform is “configurable” at the bank level, a Thought Machine spokesperson told Bank Automation News.

BankInovation

JUNE 15, 2022

The $2.5 billion Community First Credit Union has implemented customer service technology from Glia. Glia's digital customer service tools allow financial institutions to reach out to members and provide online guidance for loan applications. Service representatives can view the same screens as members and offer help with products like an auto loan, the companies said […].

The Paypers

JUNE 15, 2022

Canada-based payment service provider Clik2pay has announced it launched a Magento Commerce plug-in and a Salesforce Commerce Cloud cartridge, to seamlessly deploy its solution.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

JUNE 15, 2022

Indonesia-based fintech platform Flip has received a USD 55 million Series B extension round led by Tencent with participation from Block and Insight Partners.

The Paypers

JUNE 15, 2022

US-based fintech Sionic has launched a real-time payment (RTP) service for US merchants, enabling bank-to-bank digital cash deposits at the point-of-sale.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

The Paypers

JUNE 15, 2022

Aliaswire , a US-based provider of bill payment and credit solutions for businesses and banks, has announced the general availability of a new Multi-Payer capability in its DirectBiller platform for property management.

The Paypers

JUNE 15, 2022

Regtech provider Know Your Customer has announced its new product that will let its users access, review, and download company data and official incorporation documents from 123 countries worldwide.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content