Fintechs party like it’s 2021 at Money 20/20

Payments Dive

OCTOBER 25, 2022

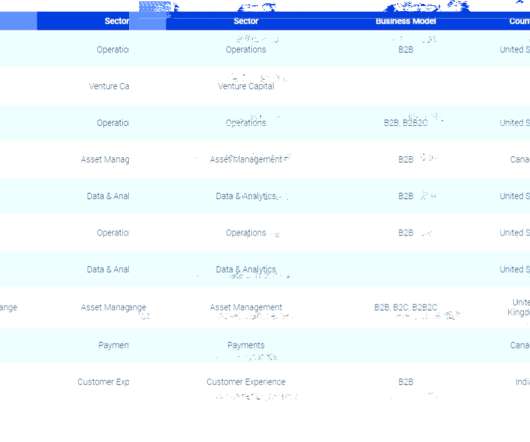

Thousands of payments and fintech professionals at the Money 20/20 conference in Las Vegas this week are racing ahead with high-growth businesses, even as a drop-off in capital threatens to ruin the celebration.

Let's personalize your content