Card debt climbs to record $1.13 trillion

Payments Dive

FEBRUARY 7, 2024

Consumers’ credit card debt rose nearly 5% in the fourth quarter, compared to the third quarter, adding to delinquencies as well.

Payments Dive

FEBRUARY 7, 2024

Consumers’ credit card debt rose nearly 5% in the fourth quarter, compared to the third quarter, adding to delinquencies as well.

Ublocal

FEBRUARY 7, 2024

Welcome to Union Bank’s exciting journey into the world of investments! We’re delighted to bring our Northern Vermont and New Hampshire communities a simple, yet powerful way to grow your money. Through our UB2Go digital banking platform , we’re introducing an easy-to-use digital investment app. You can start investing with as little as $10, joining the ranks of savvy investors right from your phone or computer.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

FEBRUARY 7, 2024

The processing and acquiring company, which seeks a “very specific” special bank charter, doesn’t intend to compete with its financial institution partners, Fiserv CEO Frank Bisignano said Tuesday.

BankUnderground

FEBRUARY 7, 2024

Daniel Norris, Elio Cucullo and Vasilis Jacovides When borrowers enter a fixed-rate mortgage, lenders test whether they could continue to afford their mortgage if interest rates were to increase by the time it comes to re-fix. This ‘stressing’ is designed to create additional resilience for borrowers and the financial system. Over the last two years, mortgage rates have increased by over four percentage points, raising the cost of repayments for those re-fixing.

Advertisement

Discover the key benefits of portfolio loans and learn how to streamline your lending process with our infographic, "5 Things Lenders Need to Know About Portfolio Loans & Their Documentation." Find out how portfolio loans can maximize borrower potential by consolidating multiple properties under a single loan, reducing paperwork, and lowering closing costs.

CFPB Monitor

FEBRUARY 7, 2024

Several national and Texas banking and business trade groups have filed a lawsuit in the U.S. District Court for the Northern District of Texas challenging the final regulations (Final Rules) implementing the Community Reinvestment Act of 1977 (CRA) that were jointly adopted in October 2023 by the Office of the Comptroller of the Currency, Federal Deposit Insurance Corporation, and Federal Reserve Board (Agencies). .

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

American Banker

FEBRUARY 7, 2024

Virgin Money has cut about 150 jobs and 39 branches thus far in 2024, the Central Bank of Nepal has hired ACI Worldwide to build a payment switch to enable interoperable card payments for merchants, and more.

BankInovation

FEBRUARY 7, 2024

Maria Mason, enterprise product manager at Citizens Bank, will speak at Bank Automation Summit U.S. 2024 about strategies for automating real-time payments (RTP). Bank Automation Summit U.S. 2024 takes place March 18-19 at the Omni Nashville in Nashville, Tenn., and brings together industry experts to discuss innovation in real-time payments, AI, RPA and more.

American Banker

FEBRUARY 7, 2024

The San Francisco-based electronic signature company's chief executive Allan Thygesen announced Tuesday that roughly 400 employees across the company were being let go as part of restructuring for the 2025 fiscal year.

BankInovation

FEBRUARY 7, 2024

Jack Henry updated its tech modernization strategy during its fiscal second quarter, the technology provider announced during its earnings call today.

Speaker: Brian Muse-McKenney, Chief Revenue Officer & Matt Simester, Cards and Payments Expert

In today’s world of social media, dating apps, and remote work, businesses risk becoming irrelevant or getting "ghosted" if they fail to meet the evolving needs of Gen Z consumers. In this new webinar, Brian Muse-McKenney of Episode Six and Matt Simester of Payments Consultancy Limited will reveal key considerations banks should factor into their efforts to develop target products for the next generation of bank customers.

American Banker

FEBRUARY 7, 2024

Anne Clarke Wolff, a longtime Most Powerful Women in Banking honoree, on why she left big banking to start her own investment bank advisory firm.

TheGuardian

FEBRUARY 7, 2024

Alessandro DiNello, new executive chairman of regional US lender, acknowledges ‘serious situation’ as stock at lowest level in decades Shares in New York Community Bancorp (NYCB) continued to fall on Wednesday, heightening unease about the US’s regional banking sector. The bank’s stock has fallen by more than 60% to its lowest level in decades in recent days despite a scramble by the mid-sized lender to reassure investors of its financial strength.

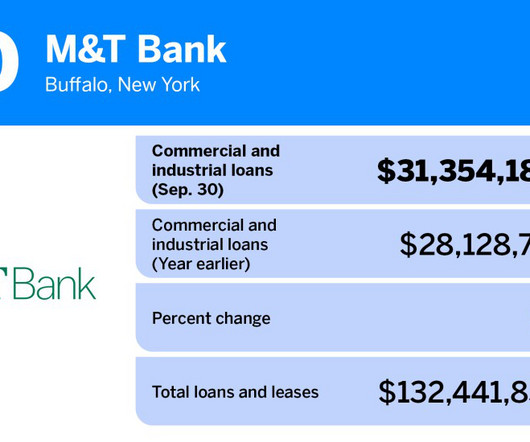

American Banker

FEBRUARY 7, 2024

The top five banks and thrifts have more than $1 trillion in combined commercial and industrial loans as of September 30, 2023.

BankInovation

FEBRUARY 7, 2024

BNY Mellon has expanded its use of Microsoft for cloud services and AI models, according to a Feb. 5 release from the bank.

Speaker: Gary Dmitriev

Our upcoming webinar aims to demystify the process of selecting and implementing automation tools for financial institutes. This session will provide your roadmap for vetting potential solutions, focusing on due diligence, vendor assessments, and aligning technology with strategic goals. We’ll also address the critical issue of innovation fatigue, offering tips on maintaining enthusiasm and momentum for new initiatives.

American Banker

FEBRUARY 7, 2024

Financial institutions' fintech partnerships are facing higher levels of scrutiny. More consistent and direct monitoring of their partners can put them in a better position.

BankInovation

FEBRUARY 7, 2024

Jack Henry updated its tech modernization strategy during its fiscal second quarter, the technology provider announced during its earnings call today.

American Banker

FEBRUARY 7, 2024

Just weeks ago, prospects seemed strong for bank stocks to regain ground after a volatile 2023. But renewed credit concerns stemming from issues at New York Community Bancorp, and the increasing odds that interest rates will remain high for months, have dampened that outlook.

The Paypers

FEBRUARY 7, 2024

UK-based financial services provider Ebury has launched a new solution for direct transactions between the Brazilian real and the Chinese yuan.

Advertisement

Discover First Mid Bank's Expansion Success with Our Case Study! Discover how First Mid Bank & Trust fast-tracked market expansion through advanced automation and compliance solutions. This case study reveals their journey from facing challenges in Texas' complex legal landscape to achieving rapid market entry with GoDocs' innovative commercial closing platform.

American Banker

FEBRUARY 7, 2024

As virtual assistants become central to banking, financial institutions of all sizes must embrace and leverage this transformation to redefine the customer experience.

The Paypers

FEBRUARY 7, 2024

US-based payment processing platform Payroc has acquired SterlingCard Payment Solutions to provide augmented card-present solutions in the Canadian market.

American Banker

FEBRUARY 7, 2024

The regional bank announced a leadership shakeup on Wednesday, capping a tumultuous week in which shareholders became spooked about its exposure to the commercial real estate sector.

The Paypers

FEBRUARY 7, 2024

Payment network UnionPay International has partnered with Spring Airlines to allow the latter’s website to accept UnionPay cards for tourists and business travellers.

Advertisement

Shifting liability for digital fraud losses represents a significant challenge for financial institutions and payment service providers. In response to the global surge in digital fraud, regulators are introducing policies that transfer the cost of fraud from defrauded customers to financial institutions. ThreatMark’s newly released white paper, "The Liability Shift: Understanding Fraud Losses Responsibility and Mitigation," provides an in-depth analysis of this shift, its implications, and stra

American Banker

FEBRUARY 7, 2024

CEO Alex Chriss told analysts the company's AI-heavy product rollouts won't improve financial results in the near-term.

The Paypers

FEBRUARY 7, 2024

UK-based embedded finance partner for brands, Aro has announced its collaboration with Equifax in order to deliver a new data-driven marketplace.

American Banker

FEBRUARY 7, 2024

Banks historically have been averse to challenging their regulators in court, but a suit over the recently finalized Community Reinvestment Act implementation rules is a signal that the times have changed.

The Paypers

FEBRUARY 7, 2024

Germany-based Commerzbank AG has announced its partnership with Surecomp to deploy its DOKA-NG tool for back-office trade finance processing across several entities.

Advertisement

Most people dread the nearing of the month-end close and reconciliation process, and who can blame them? It's typically a tedious, long, stressful process; but it doesn't have to be. Implementing automation into your month-end process can significantly reduce this headache by automating up to 40% of your reconciliation and saving nearly 30% of your time spent.

Let's personalize your content