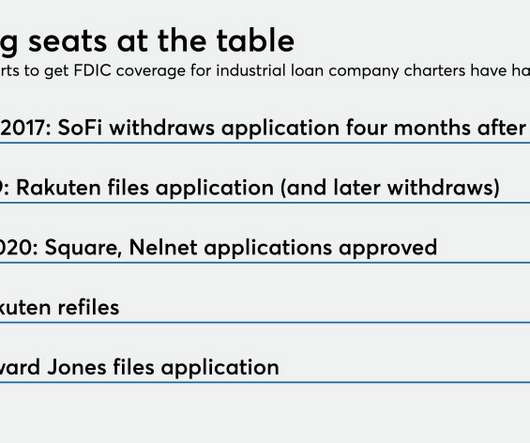

FDIC Approves Square For Banking License

PYMNTS

MARCH 19, 2020

The Federal Deposit Insurance Corporation ( FDIC ) gave the green light to an application from the FinTech firm Square to create a de novo industrial bank in Utah, the agency said on Wednesday (March 18). The Utah Department of Financial Institutions still has to issues approvals to the San Francisco-based FinTech. Square, Inc.

Let's personalize your content