Helping FI’s Develop Their ‘FinTech Sense’

PYMNTS

JANUARY 28, 2020

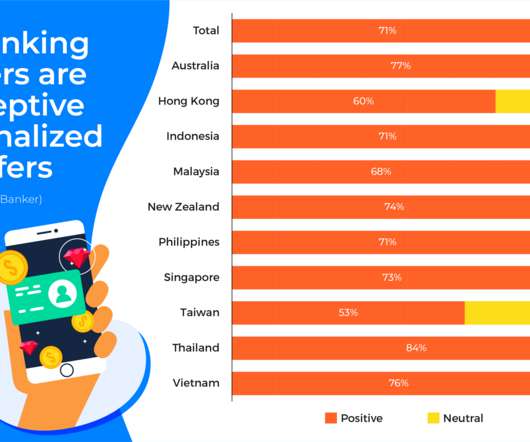

Everyone knows that digital and mobile services are key to success in the 2020s — not only in terms of more revenue, but also larger transformations. But that doesn’t mean all the players in payments and financial services have a solid or clear digital strategy. The age of personalized service is upon us.

Let's personalize your content